kastilbet.site Market

Market

Fee Free Etf

Choose from 6 ETFs. Design your 0 trading fee automated savings plan with the ETFs from our partners Vanguard, iShares and Invesco. Like mutual funds, ETFs include a small cost called the. Management Expense Ratio (MER) (opens modal window). All funds include this fee whether they tell you. Interactive Brokers' "fee waived" no transaction fee (NTF) program offers over exchange-traded funds (ETFs) which reimburse IBKR Pro clients for commissions. While ETFs trade like stocks, there are some differences when it comes to fees. Largely, that comes in the form of management expenses, which apply to ETFs. This page contains a list of all U.S.-listed ETFs and ETNs that are available for commission free trading on certain select platforms. Extensive selections of Exchange-Traded Funds (ETFs). Easy-to-analyze ETF charts and data breakdown. $0 commissions* on all US exchange-listed ETFs. Options trades will be subject to the standard $ per-contract fee. Service charges apply for trades placed through a broker ($25) or by automated phone ($5). And ETFs do not have 12b-1 fees. That said, according to Morningstar, the average index ETF expense ratio in was % and % for active ETFs, compared. Free commission offer applies to online purchase of ETFs in a Fidelity retail account. The sale of ETFs is subject to an activity assessment fee (from $ to. Choose from 6 ETFs. Design your 0 trading fee automated savings plan with the ETFs from our partners Vanguard, iShares and Invesco. Like mutual funds, ETFs include a small cost called the. Management Expense Ratio (MER) (opens modal window). All funds include this fee whether they tell you. Interactive Brokers' "fee waived" no transaction fee (NTF) program offers over exchange-traded funds (ETFs) which reimburse IBKR Pro clients for commissions. While ETFs trade like stocks, there are some differences when it comes to fees. Largely, that comes in the form of management expenses, which apply to ETFs. This page contains a list of all U.S.-listed ETFs and ETNs that are available for commission free trading on certain select platforms. Extensive selections of Exchange-Traded Funds (ETFs). Easy-to-analyze ETF charts and data breakdown. $0 commissions* on all US exchange-listed ETFs. Options trades will be subject to the standard $ per-contract fee. Service charges apply for trades placed through a broker ($25) or by automated phone ($5). And ETFs do not have 12b-1 fees. That said, according to Morningstar, the average index ETF expense ratio in was % and % for active ETFs, compared. Free commission offer applies to online purchase of ETFs in a Fidelity retail account. The sale of ETFs is subject to an activity assessment fee (from $ to.

At Questrade, you can buy ETFs for free. Selling them has the same low fee as trading a stock: 1¢ /share (min. fee per order of $, max. of $). There are no trading commissions when you buy and sell any of free ETFs with Qtrade Direct Investing online brokerage. Stocks, ETFs, Warrants and Structured Products · United States - Third Party Fees · Commission Free ETFs · Alternate Exchange Commissions · United States - Examples. The SPDR® S&P® Fossil Fuel Reserves Free ETF seeks to provide investment results that, before fees and expenses, correspond generally to the total. No minimum initial investment requirement. You don't need thousands of dollars to start investing in an ETF. You can buy a Vanguard ETF for as little as $1. Interactive Brokers' "fee waived" no transaction fee (NTF) program offers over exchange-traded funds (ETFs) which reimburse IBKR Pro clients for commissions. Brokerage fees and comissions by the bank. Save with American and Canadian ETFs $ 0 commission and our pricing for active investors. You can buy and sell ETFs available through the Firstrade's commission-free ETF program without paying brokerage commissions. The commission-free trades on ALL. Commission-free trading on eligible U.S. stocks and ETFs · Wide selection of commission-free ETFs from market leaders such as Vanguard, GlobalX, iShares, and. The abrdn Bloomberg All Commodity Strategy K-1 Free ETF (the "Fund") seeks to provide investment results that closely correspond, before fees and expenses. Firstrade lets you trade every ETF available in the market and offers more commission-free ETF trading opportunities than any other broker. Answer a few questions to explore our extensive list of commission-free ETFs that are right for you. Select the asset class you're interested in. Invest your way, commission-free Build your own portfolio with thousands of stocks, ETFs, and options — all on our powerful, yet easy-to-use trading platform. Firstrade offers commission-free trading on all its ETFs and customers will have more than 2, funds to choose from. You'll also have free access to. ECN (Electronic Communication Network) fees may still apply, but you won't pay commissions with Questrade. If you decide to sell the ETF, you'll pay the. Get 50 commission-free stock trades, commission-free unlimited TD Exchange-Traded Fund (TD ETF) trades, save on currency conversion, trade partial shares and. ETFs) can help you lower costs and increase your return potential. If you are not a client of TD or already work with an investment professional, feel free to. Commission fees for these ETFs are on the house. You only pay a €1 handling fee. Currency, connectivity, or external product and spread costs may apply. The ETF. Commission-free ETFs - Equity. Symbol. ETF Name. Geographic. Region. Strategy. Listed Market. XSP. iShares Core S&P Index ETF (CAD-Hedged). US. Index. Other fees may apply. Free and $0 means there is no commission charged for these trades. $0 option trades are subject to a $ per-contract fee. Sales are.

What To Eat In Day To Lose Weight

Focus on whole foods: Base your diet around whole, unprocessed foods such as fruits, vegetables, lean proteins, whole grains, and healthy fats. If you're not eating healthy nor are you reasonably active, weight loss will be much harder. You're unlikely to lose weight quickly until you incorporate. 12 Metabolism-Boosting Foods to Aid Weight Loss · 1. Fish & Shellfish · 2. Legumes (Also known as beans) · 3. Chili Peppers · 4. Lean Meats · 5. Low-Fat Milk · 6. Oats – Oats are rich in fiber and complex carbohydrates which are needed to keep your metabolism up by keeping insulin levels low after a meal. Eating foods. Hey guys! Today I'm sharing with you the weight loss meal plan that I used to lose weight (40 Lbs)! I've created this meal plan for women. Yoghurt and Fruit: 1 tub (g) low fat/no added sugar yoghurt + 1 serve of fruit (eg. 2 nectarines or mL fruit juice or 1 apple). Lunch. Tuna Salad Sandwich. This is everything I eat in a day when I want to lose weight fast, but in a healthy way. These are the easy recipes & meals I eat from my 7. · 1: Make breakfast your biggest meal of the day. · 2: Eat dinner four hours before bedtime, rather than right before bedtime. · 3: Eat lunch earlier. Nosh on Nuts to Decrease Your Appetite Nuts pack in protein and fiber, according to the Mayo Clinic, which makes them filling foods. A daily serving may also. Focus on whole foods: Base your diet around whole, unprocessed foods such as fruits, vegetables, lean proteins, whole grains, and healthy fats. If you're not eating healthy nor are you reasonably active, weight loss will be much harder. You're unlikely to lose weight quickly until you incorporate. 12 Metabolism-Boosting Foods to Aid Weight Loss · 1. Fish & Shellfish · 2. Legumes (Also known as beans) · 3. Chili Peppers · 4. Lean Meats · 5. Low-Fat Milk · 6. Oats – Oats are rich in fiber and complex carbohydrates which are needed to keep your metabolism up by keeping insulin levels low after a meal. Eating foods. Hey guys! Today I'm sharing with you the weight loss meal plan that I used to lose weight (40 Lbs)! I've created this meal plan for women. Yoghurt and Fruit: 1 tub (g) low fat/no added sugar yoghurt + 1 serve of fruit (eg. 2 nectarines or mL fruit juice or 1 apple). Lunch. Tuna Salad Sandwich. This is everything I eat in a day when I want to lose weight fast, but in a healthy way. These are the easy recipes & meals I eat from my 7. · 1: Make breakfast your biggest meal of the day. · 2: Eat dinner four hours before bedtime, rather than right before bedtime. · 3: Eat lunch earlier. Nosh on Nuts to Decrease Your Appetite Nuts pack in protein and fiber, according to the Mayo Clinic, which makes them filling foods. A daily serving may also.

Eating well is an important part of a healthy lifestyle. Consuming a balanced mix of nutritious foods can help your body feel its best. change what you eat. That does not mean you need to do a cleanse or detox. But it is possible to get a jump on weight loss, · the smart and healthy way. Fitbit. That study's results showed that reducing the number of large meals or eating more small meals may be associated with minimizing weight gain or even with weight. Drink low-fat milk and water instead of sugary drinks. Eat at least 5 servings a day of fruits and veggies. Include a variety protein in your diet. Protein. How to eat healthier meals · Veg: go for 2 or more · Protein: prize it! · Carbs: stick to wholegrain · Fish: try twice a week · Dairy: keep it light and low · Oils. For someone who weighs lbs (68kg), this would equate to g fat per day. · Low Fat Diets for Weight Loss · Saturated fats · Unsaturated fats · monounsaturated. Download the free NHS Weight Loss Plan to help you start healthier eating habits, be more active, and start losing weight. 17 Best Foods That Aid in Safe Weight Loss, According to Registered Dietitians · Blueberries · Peas · Chia seeds · Pumpkin · Chickpeas · Oats · Kefir · Raspberries. In addition, two snacks consisting of fruits, vegetables, or diet snack bars are recommended each day. The mechanisms for weight loss on a low-fat diet are. The best diet for losing weight while working out is one that includes high-quality foods that are unrefined and minimally processed. A balanced diet should. soy; eggs; dairy; meat; fish; poultry; beans · legumes · grains · nuts. Can you lose weight by eating high protein foods? These diets usually allow about 1, to 1, calories a day for women and 1, to 1, calories a day for men. An LCD is a better choice than a VLCD for. Cap your intake of the most carbohydrate-dense foods, such as grains and spuds, at just a couple of servings a day. Eat them before or after training or any. Healthy eating can feel like a numbers game – especially if you're trying to remember the limits for fat, sugar and salt, whilst also getting your five portions. Aim for about daily calories for dinner. This is the same size meal as lunch, and depending on your activity level, you can increase the calories here. When it comes to losing weight, a general rule of thumb is to consume fewer calories than needed to maintain your present weight. calories a day is. Nutritional Guidelines suggest a daily intake of and grams of protein per kilogram, or and 1 grams per pound to lose weight. Athletes and heavy. Determine your weight loss goals. Recall that 1 pound (~ kg) equates to approximately calories, and reducing daily caloric intake relative to estimated. If you have time to start the day with protein, such as eggs, you may find that you are not hungry again until lunch. Other high-protein options are yogurt. Determine your weight loss goals. Recall that 1 pound (~ kg) equates to approximately calories, and reducing daily caloric intake relative to estimated.

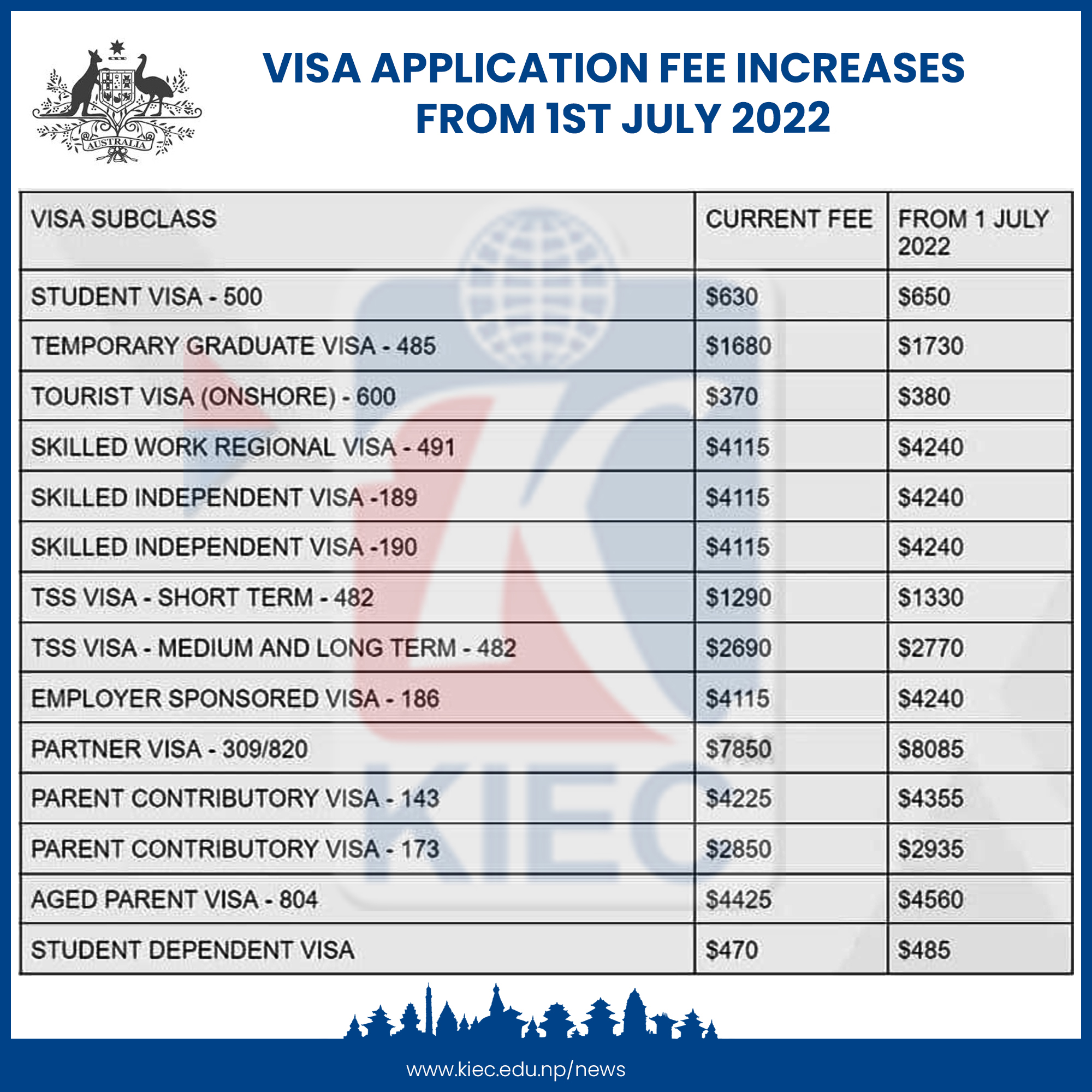

Visa Annual Fee

ANNUAL FEE. $0. Recommended credit score. Excellent, Good / Excellent. Apply. Select to compare. Compare now. Details. Wells Fargo Active Cash® Card Rates and. Earn 1% in Rewards Dollars with the Disney Visa Card from Chase. Get 10% savings at select Disney locations and 0% promo APR on select Disney vacation. ANNUAL FEE. $0. Recommended credit score. Excellent, Good / Excellent. Apply 0% Intro APR on Purchases for 12 Months. REGULAR APR. % - % Variable. We're proud to offer Visa credit cards that fit any lifestyle. Get points, cash back or low rates on cards with no annual fee. Or choose a premium card for. No annual fee. Flexible due dates. See if you're approved in seconds. 9, reviews. Fees · $49 annual fee · No balance transfer fees · No foreign transaction fees · No cash advance fees. Visa Credit Card Interest Rates ; Annual Percentage Rate (APR) for Purchases · % · % to % · % to % ; APR for Balance Transfers · %. NIHFCU Visa Cards – Wellness for your wallet · Visa® Credit Cards · Visa® Platinum Card · Visa® Signature Cash Rewards · Visa® Signature Travel Rewards · Visa®. ANNUAL FEE. $0 intro annual fee for the first year, then $†. ANNUAL FEE. $0. Recommended credit score. Excellent, Good / Excellent. Apply. Select to compare. Compare now. Details. Wells Fargo Active Cash® Card Rates and. Earn 1% in Rewards Dollars with the Disney Visa Card from Chase. Get 10% savings at select Disney locations and 0% promo APR on select Disney vacation. ANNUAL FEE. $0. Recommended credit score. Excellent, Good / Excellent. Apply 0% Intro APR on Purchases for 12 Months. REGULAR APR. % - % Variable. We're proud to offer Visa credit cards that fit any lifestyle. Get points, cash back or low rates on cards with no annual fee. Or choose a premium card for. No annual fee. Flexible due dates. See if you're approved in seconds. 9, reviews. Fees · $49 annual fee · No balance transfer fees · No foreign transaction fees · No cash advance fees. Visa Credit Card Interest Rates ; Annual Percentage Rate (APR) for Purchases · % · % to % · % to % ; APR for Balance Transfers · %. NIHFCU Visa Cards – Wellness for your wallet · Visa® Credit Cards · Visa® Platinum Card · Visa® Signature Cash Rewards · Visa® Signature Travel Rewards · Visa®. ANNUAL FEE. $0 intro annual fee for the first year, then $†.

Benefit Level. Visa Infinite®. Visa Signature®. Visa Traditional® ; Credit score. Excellent. Good. Fair ; Features. Travel. Cash Back. No Annual Fee. Visa may be the largest of the credit card networks with the widest acceptance rate, but you might run into a merchant that won't take Visa cards. If this is. Occasional travelers who want to earn miles for Korean Air award travel without an annual fee. SKYPASS Visa Signature® Card. Apply now · Learn more. Earn 40, Fees. Annual Fee. None. Skip Table. Transaction Fees. • Balance Transfers. 5% for each balance transfer, with a minimum of $5. • Cash Advances. Either $10 or 5%. A fee of 5% of the amount of each balance transfer, cash advance and convenience check applies. No annual fee. Cash back rewards never expire. Redeem cash back. See the Verizon Visa® Credit Card Rewards Program Terms & Conditions in application for details and restrictions. NO ANNUAL FEE: For New Accounts as of 05/30/ Choose from a range of contactless Elevations Visa® Credit Cards with no annual fees (on any card) and options fit for every lifestyle (always). From our. The U.S. Bank Visa® Platinum credit card provides great benefits with no annual fee. Learn more and apply today at U.S. Bank. You can spend your rewards or deposit them into any eligible Fidelity account,2 giving your money more chances to grow. No annual fee, foreign transaction fee. 1% cash back on all other eligible spend. $0 annual fee. See details below. Cash back Visa credit card from U.S. Bank. Milestone Gold Mastercard · Annual Fees · $59* · Second year includes monthly fees of up to $ ($ annually). $ online cash rewards bonus offer and 3% cash back in the category of your choice. No annual fee †. Tap to Pay. If a payment is late or returned, a fee is assessed. For balance transfers, a fixed dollar amount or a fee is charged. There is no annual fee for the Alliant. Save with no annual fee and no balance transfer or cash advance fee. Coast view Visa Value credit card. Visa Rewards credit card rates as low as % APR. No annual credit card fee You won't have to pay an annual credit card fee† Opens pricing and terms in new window for all the great features that come with. Variable annual percentage rate ranges from % to % based on card type and creditworthiness. 1% foreign transaction fee. Balance transfers and cash. No annual fee, no balance-transfer fees, no cash-advance fees, and no foreign-transaction fees. Option to receive free and secure online statements; End-of-year. Introductory APR. None ; Standard APR. % - %. variable ; Annual Fee. $95 ; Balance Transfer Fee. 4%. of each transaction. ANNUAL FEE. $ Recommended credit score. Excellent. Apply. Select to compare. Compare now. Details. Capital One Venture X Rewards Credit Card Rates and Fees. Details · No annual fee, and no security deposit required · % cash back at select local and national merchants · See if you're pre-approved in minutes.

Where To Put Money Instead Of Savings Account

A CD account typically requires a higher balance than savings accounts, and your funds will usually remain on deposit for a fixed period of time. Money market account. Money market accounts are similar to savings accounts but typically earn higher interest rates and require higher minimum balances. Most. When you save money in a bank account or CD, you earn a steady amount of interest and keep your principal intact. When you invest in the stock market or real. What happens when I need to access those funds? Once you've hit a certain goal, or need to use the money, you can either visit your nearest branch to withdraw. Instead, you may be better off looking into an investment account that lets you buy stocks, bonds, mutual funds, or exchange-traded funds (ETFs). Deposits (cash and cheques); Withdraw money (at ATMs, bank tellers, etc.) One-time purchases (groceries, gas, etc); One-time or. The best bet is Mutual Funds. Keep your funds in various baskets of funds, You will surely reap more benefits than conventional Bank deposits. A savings account · A certificate of deposit (CD), which locks in your money for a fixed period of time at a rate that is typically higher than that of a savings. Money in a savings account is not an investment, it is to have instant access to money. The alternative is to have cash at home, but instant. A CD account typically requires a higher balance than savings accounts, and your funds will usually remain on deposit for a fixed period of time. Money market account. Money market accounts are similar to savings accounts but typically earn higher interest rates and require higher minimum balances. Most. When you save money in a bank account or CD, you earn a steady amount of interest and keep your principal intact. When you invest in the stock market or real. What happens when I need to access those funds? Once you've hit a certain goal, or need to use the money, you can either visit your nearest branch to withdraw. Instead, you may be better off looking into an investment account that lets you buy stocks, bonds, mutual funds, or exchange-traded funds (ETFs). Deposits (cash and cheques); Withdraw money (at ATMs, bank tellers, etc.) One-time purchases (groceries, gas, etc); One-time or. The best bet is Mutual Funds. Keep your funds in various baskets of funds, You will surely reap more benefits than conventional Bank deposits. A savings account · A certificate of deposit (CD), which locks in your money for a fixed period of time at a rate that is typically higher than that of a savings. Money in a savings account is not an investment, it is to have instant access to money. The alternative is to have cash at home, but instant.

Whether you can deposit cash into an HYSA depends on your provider. Many HYSA are offered by online-only banks, so you may not be able to make cash deposits at. Consider the Vanguard Cash Plus Account, money market funds, or brokered certificates of deposit (CDs) to save for your short-term goals. The 5 Best Alternatives to Bank Savings Accounts · 1. Higher-Yield Money Market Accounts · 2. Certificates of Deposit (CDs) · 3. Credit Unions and Online Banks · 4. The best place for most people is a money market fund because (a) they have higher yield than nearly all savings accounts and (b) they have potential tax. Instead, put this cash into a savings account that offers more security. For your longer-term goals that allow you to take on more risk put that money in the. A CD typically pays more interest, but access to your money is limited. Savings account. The most basic account for saving available through a. A savings account is like a piggy bank. It's a secure bank account meant to hold and protect your money for future use. Key features. Earns interest to help. While saving and investing are similar, they have important differences. · Saving is the act of putting money somewhere safe for use in an emergency or for a. For example, savings accounts do not use checks for payments and may be used for putting money aside to reach a savings goal. A Huntington savings account also. Our Money Market account It also helps prevent savers from spending money on an impulse buy instead of putting it toward their longer-term financial goals. A CD typically pays more interest, but access to your money is limited. Savings account. The most basic account for saving available through a. With a savings account, you can maintain your savings in a liquid state—meaning you can access your funds whenever you want—while also putting some space. Saving is a way of storing your money until you need it. Whereas investing is about putting your money to work for you – and with this, comes more risk. One way to grow your money safely is to save it in an interest-bearing account. Banks, credit unions, and other financial institutions offer high-yield savings. The Emergency Savings Account is designed to build healthy saving habits by saving money for a rainy day. Setting up the automatic transfer, direct deposit or. Plus, you can access your funds at any time unlike with certificates of deposit (CDs) that require your money to be untouched for a set timeframe. Additional. interest (annual percentage yield or APY), helping your savings grow (once you hit the minimum deposit) · liquidity, letting you easily access your money with no. Savings accounts and certificates of deposit (CDs) are among the safest ways to protect your money and reach short- and long-term financial goals. Rather than receiving and depositing a check every pay period (or other checks This can be another alternative to sending money to your savings account. The interest-bearing Platinum Savings account gives you several easy ways to get to your money when you need it, including online and mobile access.

Itil Vs Agile

Agile Service Management in practice · Involve your customers in designing your processes and services. · When releasing a new product, release a basic solution. ITIL and the Information Lifecycle: Integrating agile, DevOps and ITSM [Axelos, Darren Arcangel, Brian Johnson, Nora Osman, Robert Zuurdeeg] on kastilbet.site Agile is all about being collaborative and flexible, while procedures and processes characterize ITIL. On the surface, Agile methods seem to accelerate delivery. ITIL being Service Management framework provides the support for products and services that are being built and deployed using DevOps practices. ITIL 4 has. Furthermore, ITIL has a development lifecycle based on principles that are almost identical to the software development lifecycle used by both Agile and DevOps. 3 life cycle in order to align it with agile project management. These modifications enable to organize the information exchanges and the work coordination. Teams that want hierarchical structures and well-defined procedures should consider using ITIL. It promotes accountability and efficiency by clearly defining. By marrying (adopting and adapting) ITIL and Agile you get to utilise the best of both worlds, it is also a great opportunity to bring together traditional. Agile Service Management in practice · Involve your customers in designing your processes and services. · When releasing a new product, release a basic solution. Agile Service Management in practice · Involve your customers in designing your processes and services. · When releasing a new product, release a basic solution. ITIL and the Information Lifecycle: Integrating agile, DevOps and ITSM [Axelos, Darren Arcangel, Brian Johnson, Nora Osman, Robert Zuurdeeg] on kastilbet.site Agile is all about being collaborative and flexible, while procedures and processes characterize ITIL. On the surface, Agile methods seem to accelerate delivery. ITIL being Service Management framework provides the support for products and services that are being built and deployed using DevOps practices. ITIL 4 has. Furthermore, ITIL has a development lifecycle based on principles that are almost identical to the software development lifecycle used by both Agile and DevOps. 3 life cycle in order to align it with agile project management. These modifications enable to organize the information exchanges and the work coordination. Teams that want hierarchical structures and well-defined procedures should consider using ITIL. It promotes accountability and efficiency by clearly defining. By marrying (adopting and adapting) ITIL and Agile you get to utilise the best of both worlds, it is also a great opportunity to bring together traditional. Agile Service Management in practice · Involve your customers in designing your processes and services. · When releasing a new product, release a basic solution.

DevOps is pitched as a mechanism to bring operations teams into the agile fold, but that doesn't signal the end of ITIL. In fact, abandoning ITIL would be a. While Agile is mainly designed for software development, ITIL focuses on delivering and managing IT services. Agile takes an incremental approach to software. Agile and ITIL (Information Technology Infrastructure Library) are two methodologies that, while distinct in their approaches and primary focus areas. DevOps is pitched as a mechanism to bring operations teams into the agile fold, but that doesn't signal the end of ITIL. In fact, abandoning ITIL would be a. ITIL is more of a management methodology for IT, as a whole, which encompasses change management, risk assessment, business value, and command. ITIL (which I have), helps alot with mgmt of IT Infrastructure process while Agile is a Software Development philosophy. 3 and agile methods, since ITIL implies a serial way of work in service design, while agile is based on iterations and small size deliveries of almost complete. In the past, ITIL and Agile seemed to oppose each other as ITIL is a framework and Agile is a mindset. Of late, many have found the benefits of. Agile Service Management (ASM) ensures that service management processes reflect agile values and are designed with “just enough” control and structure to. Agile service management enables you to have lean, customer-centric processes and supports short iteration cycles of improvement. Under minimal constraints, you. That's why it seems that ITIL is a good option for standard changes, and an Agile mindset is suitable for non-standard changes. Agile focuses on individuals and. DevOps is the practice of bridging the gap between development and operations. Its core principles are open communication, collaboration, and shared goals. As. Agile, on the other hand, is a methodology used in software development that emphasizes delivering small, workable parts of a project frequently. Framework vs. ITIL is still relevant, in places. ITIL 4 is a huge improvement on v3 because it introduces the ITSM community to agile and lean practices. ITIL 4 is equally applicable to all service organizations and it is a complementary framework to other ways of working, like Lean, Agile and DevOps. One of the major obstacles in the joining of Agile and ITIL is the reality that ITIL pursues successive system, though Agile is an iterative methodology where. ITIL 4 is equally applicable to all service organizations and it is a complementary framework to other ways of working, like Lean, Agile and DevOps. It is a highly structured model built to boost productivity and offer statistics for IT teams. ITIL is a subset of ITSM; it primarily focuses on procedures for. 3 life cycle in order to align it with agile project management. These modifications enable to organize the information exchanges and the work coordination. Kanban is excellent to track a project while ITIL is good at process. ITIL is about process and not individual. While Kanban or Scrum is about Individual and he.

84 Month Used Auto Loan

I used to use a bank out of New England for around 15 years and always used a 72 month loan. Had an 84 once. The reason I liked these loans. Vehicle loans · Great low rates currently as low as % APR1 for new vehicles and % APR1 for used vehicles and refinances. · Terms up to 84 months · Finance. Buying a car from a private seller and need financing options? TD has flexible auto loan options for financing private car sales. Visit TD today! Up to month kastilbet.site Auto Loans. boat-loan-suncoast. Boat Loans. Purchase Used A.T.V. 72 month maximum. Payment Example: 60 payments of $ per. Up to 36 months, % APR. 37 - 60 months, % APR. 61 - 72 months, % APR. 73 - 84 months, % APR. USED Auto Loan Rates. Term, Rates as low as: Up to. Electrical Worker's #22 Federal Credit Union is offering month auto loans. We are also offering used auto loan financing for up to 72 months at reduced. The calculator will give your estimated weekly, biweekly, or monthly payments and the cost of borrowing. Finance calculator. What can I afford? 36 months is the maximum any auto loan should be for good fiscal reasons, including longevity of the vehicle, warranty etc. 48 months is. Free auto loan calculator to determine the monthly payment and total cost of an auto loan, while accounting for sales tax, fees, trade-in value, and more. I used to use a bank out of New England for around 15 years and always used a 72 month loan. Had an 84 once. The reason I liked these loans. Vehicle loans · Great low rates currently as low as % APR1 for new vehicles and % APR1 for used vehicles and refinances. · Terms up to 84 months · Finance. Buying a car from a private seller and need financing options? TD has flexible auto loan options for financing private car sales. Visit TD today! Up to month kastilbet.site Auto Loans. boat-loan-suncoast. Boat Loans. Purchase Used A.T.V. 72 month maximum. Payment Example: 60 payments of $ per. Up to 36 months, % APR. 37 - 60 months, % APR. 61 - 72 months, % APR. 73 - 84 months, % APR. USED Auto Loan Rates. Term, Rates as low as: Up to. Electrical Worker's #22 Federal Credit Union is offering month auto loans. We are also offering used auto loan financing for up to 72 months at reduced. The calculator will give your estimated weekly, biweekly, or monthly payments and the cost of borrowing. Finance calculator. What can I afford? 36 months is the maximum any auto loan should be for good fiscal reasons, including longevity of the vehicle, warranty etc. 48 months is. Free auto loan calculator to determine the monthly payment and total cost of an auto loan, while accounting for sales tax, fees, trade-in value, and more.

An month car loan is a financing agreement to buy a new or used vehicle with a seven-year loan offer. It's also one of the long-term car financing options. Why choose WESTconsin for your Auto Loan · % financing available · Flexible loan terms up to 84 months for new or used vehicles · No prepayment penalties―reduce. Car or Light Truck Loan ; up to 48 months, % ; up to 66 months, % ; up to 72 months, % ; up to 78 months, % ; up to 84 months, %. Includes cars, pickup trucks, SUVs, etc. New, 60 Month (5-year), %. 72 Month (6-year), Looking to buy a new car? We'll do the math for you. Scotiabank free auto loan calculator gives you estimate for car loan, monthly payment, interest rate, and. Used Auto includes previously titled vehicles 8 years old or newer. Up to % financing not to exceed the lesser of MSRP or the final purchase price plus tax. Choose the payment that works best for your budget with flexible terms up to 84 months. exchange. Refinance. Move your existing auto loan to SFCU and we may. The most common lengths of car loans may range anywhere from 36 to 84 months total, though some may be shorter or longer. 0 to 48 months, None, % to % ; 49 to 66 months, None, % to % ; 67 to 72 months, $10, For 72 Month Term, % to % ; 73 to 84 months. For newer models (up to 3 years old), you can save even more money with month terms and affordable monthly payments. **$15, minimum for used vehicles. Auto Loans ; New & Used Recreational Vehicle Loan, months, %, $ ; New & Used Recreational Vehicle Loan · months ($20K min), %, $ Pick your term – anywhere from 1 to 84 months. The flexibility you need to get the payment you want. Rate Discounts. Go ahead –. Scenic roads. Swift waters. Single-track trails. Daily driving. ; New Auto Loans. New car financing for up to 84 months; Get pre-approved before you shop ; Used. Auto loan payment example: A $15, loan amount on a vehicle with 20% down, an excellent credit score, a 60 months term and a % APR, the monthly payment. As a very simple example, borrowing $32, for five years at 6% will require a payment of $ per month, with a total interest payment of $5, over. Enjoy low fixed rates on both new and used vehicles , with up to % financing, and terms from 12 to 84 months. Why Finance Your Next Auto with FCU? · Months repayment terms · Option to defer payments for 90 days · % financing available · Get pre-approved before. Used car (dealer): Example: A 5-year, fixed-rate used car loan for $32, would have 60 monthly payments of $ each, at an annual percentage rate (APR) of. Use Bank of America's auto loan calculator to determine your estimated monthly payments and your approximate rate for a new or used car loan. No payments for up to 90 days¹ · Up to % financing of purchase price including tax, license, and warranty² · Competitive interest rates · Terms up to 84 months.

Private Label Card

Private label credit cards: These can usually be used at the store or But unlike a credit card, charge cards don't usually come with a set spending limit. Co-brand credit cards and PLCCs encourage increased consumer spending while providing benefits and rewards to most valued customers. Managed by banks or commercial finance companies, private label credit cards don't have standard credit card logos (i.e. Visa, Mastercard) and in most cases. Kohl's Links Loyalty Rewards To Apple Pay. Kohl's has integrated its private label credit card and loyalty program with a contactless, one-click payment option. Private label cards are branded payment solutions that enable businesses to offer customized rewards, incentives, and financing options to their customers and. A credit card is a bank payment card used to pay for online purchases, via POS terminals and withdraw cash from ATMs within a credit limit set by the bank. Synchrony Financial (NYSE:SYF) is pleased to be among the first issuers to offer private label credit cardholders the ability to add their cards to Apple Pay. Private label credit cards often come with rewards and other benefits, such as exclusive discounts, that are specific to that retailer. The benefits and features available on Synchrony Bank-issued private label credit cards can be easily accessed by cardholders through Samsung Pay. Private label credit cards: These can usually be used at the store or But unlike a credit card, charge cards don't usually come with a set spending limit. Co-brand credit cards and PLCCs encourage increased consumer spending while providing benefits and rewards to most valued customers. Managed by banks or commercial finance companies, private label credit cards don't have standard credit card logos (i.e. Visa, Mastercard) and in most cases. Kohl's Links Loyalty Rewards To Apple Pay. Kohl's has integrated its private label credit card and loyalty program with a contactless, one-click payment option. Private label cards are branded payment solutions that enable businesses to offer customized rewards, incentives, and financing options to their customers and. A credit card is a bank payment card used to pay for online purchases, via POS terminals and withdraw cash from ATMs within a credit limit set by the bank. Synchrony Financial (NYSE:SYF) is pleased to be among the first issuers to offer private label credit cardholders the ability to add their cards to Apple Pay. Private label credit cards often come with rewards and other benefits, such as exclusive discounts, that are specific to that retailer. The benefits and features available on Synchrony Bank-issued private label credit cards can be easily accessed by cardholders through Samsung Pay.

All of the private label credit card accounts issued by a particular card issuer with credit cards usable at the same merchant or affiliated group of merchants. I was employed at a credit card company at one of the major banks. We used to use the banks relaxed credit granting criteria when opening up. The movement to virtual private label cards housed within retailer mobile apps foretells the eventual demise of the physical card: Already, more than 30% of. Kudos to Ulysses!!!” Nora C Customer email 7/6/ Cardholders love Imprint's product experience. 90% of customers download and use our custom iOS and android. A private label credit card is a type of card only usable at a specific store. Learn about the benefits and drawbacks, and how to get a private label credit. Private-Label Card. Become a private label card issuer, offering your own branded card, which can be either associated with a payment brand or not. Without a. Private label cards can be debit or prepaid cards that customers can use at a specific store or group of stores. Because they are exclusively valid for a. White Label Credit Solutions. Your card. Your brand. Your expanded reach custom credit card. Build a card around your business and cardholders. You. As the largest issuer of private label credit cards in the US, a partnership with Synchrony provides end-to-end solutions to help you simplify your business. As the largest issuer of private label credit cards in the US, a partnership with Synchrony provides end-to-end solutions to help you simplify your business. The largest PLCC issuers had $ billion in card receivables on their books at the end of , according to a newly published Packaged Facts report. Private Label Credit Cards (PLCC): Boost loyalty & sales with retailer-specific credit cards offering exclusive benefits & shopping experience. Private label debit refers to a merchant-branded card or mobile payment app that utilizes an automated clearing house (ACH) to directly debit consumer. Private Label Cards. Private label cards are issued by private companies. They enable cardholders to borrow money to pay for goods exclusively at the issuing. In payments industry parlance, a private label card is a retailer-branded card that can only be used at that retailer's outlets. Also called a. With rewards options that increase revenue, private label and co-branded credit cards drive engagement and provide incentive to your most loyal customers. Private label and co branded credit cards can drive value for retailers and issuers. How do you boost revenue despite the stagnant growth in partnership. A private label credit card (PLCC) is a credit card that is branded for a specific retailer. A PLCC is not processed on normal credit card processing networks. Co-branded credit cards are often confused with private label credit cards, colloquially known as store cards. Store cards are more restrictive and can only be. Bank and Retailer are entering into this Agreement to establish a private label revolving consumer credit program, which will be made available to qualified.

Should I Sign Up For A Credit Card

New Queries: A good credit score is built slowly, over time. If you apply for too many credit cards, too quickly, you'll end up damaging your score a little. Step 3: Complete the application · Your full name · Social Security number · Date of birth (must be at least 18) · Current address · Annual income · Current employer. Whether or not to get a credit card now depends on your habits and your financial status. Do you have a job? Are you able to pay all of your. The lower the APR, the better. Be sure to review disclosures and understand that an APR can adjust to a higher amount. You should also consider annual fees and. At the end of the day, getting a credit card can either be a great way to build credit and finance purchases but it can also hurt your credit score and cause. How often should you apply for a credit card? It's true that keeping multiple credit cards can sometimes benefit your credit scores. But that doesn't mean you. Your credit scores may immediately decrease by a few points when you apply for a new credit card. · Opening a new credit card can reduce your utilization rate. If you need a credit card today, you should apply for an American Express card, a Capital One card or a store credit card that offers instant use. Many of us use credit cards irresponsibly and end up in debt. However, contrary to popular belief, if you can use the plastic responsibly, you're actually much. New Queries: A good credit score is built slowly, over time. If you apply for too many credit cards, too quickly, you'll end up damaging your score a little. Step 3: Complete the application · Your full name · Social Security number · Date of birth (must be at least 18) · Current address · Annual income · Current employer. Whether or not to get a credit card now depends on your habits and your financial status. Do you have a job? Are you able to pay all of your. The lower the APR, the better. Be sure to review disclosures and understand that an APR can adjust to a higher amount. You should also consider annual fees and. At the end of the day, getting a credit card can either be a great way to build credit and finance purchases but it can also hurt your credit score and cause. How often should you apply for a credit card? It's true that keeping multiple credit cards can sometimes benefit your credit scores. But that doesn't mean you. Your credit scores may immediately decrease by a few points when you apply for a new credit card. · Opening a new credit card can reduce your utilization rate. If you need a credit card today, you should apply for an American Express card, a Capital One card or a store credit card that offers instant use. Many of us use credit cards irresponsibly and end up in debt. However, contrary to popular belief, if you can use the plastic responsibly, you're actually much.

Are you considering opening a new credit card but wondering if the impact to your credit score will outweigh the benefits of a sign-up bonus or 0% APR savings? Having a credit card is a powerful way to build credit and credit history. It's a big step, but not a difficult one to take — if you know what to expect. Applying for your first credit card is a major financial milestone. So what should you do to make sure you're building good credit with it? Your best bet is to. Credit cards can help you build your credit history and handle short-term budget crunches, but they can also be expensive if you carry a balance. If you apply for credit cards too frequently, card issuers may see this as a red flag and a potential indicator that you may not be a responsible cardholder. Whether or not to get a credit card now depends on your habits and your financial status. Do you have a job? Are you able to pay all of your. Once a customer agrees to apply for a card, the card issuer has some legal duties. They must disclose important details about the card (including the interest. Start by thinking about what you want to use the credit card for. This could be to buy things on line or on holiday, to pay your bills or to spread the cost of. If you're new to credit or you're trying to bounce back from previous financial mishaps, your top priority should probably be to build credit. Unfortunately. A business credit card is a great asset to any small business owner, and the best time to apply is when your personal credit score is high, you have an. When handled responsibly, a credit card can help you build your credit history, which could be helpful when looking for an apartment, a car loan, and even a job. When handled responsibly, a credit card can help you build your credit history, which could be helpful when looking for an apartment, a car loan, and even a job. Same for your golf clubs—they have to be just right for you. You should apply that same thinking when choosing a new credit card. If you pay off your balance. While many parents may worry that their teens aren't responsible enough to handle credit cards, giving them one can help enhance young adults' financial. A Visa prepaid card could be the way to go. Its a more secure, convenient solution to everyday spending. Explore prepaid cards. Advertiser Disclosure. Card. Applying for a credit card can be the first step to building credit and earning rewards. That's if you're approved and use it responsibly, which means doing. How often should you apply for a credit card? It's true that keeping multiple credit cards can sometimes benefit your credit scores. But that doesn't mean you. The Truth in Lending Act prohibits a bank from issuing credit cards except in response to an oral or written request or application for the card. If this is the case, the back of your card may say something like “not valid unless signed.” In this case, you should sign your card. Otherwise, while modern. You plan to apply for financing soon: A clean credit report and high credit score are key to scoring financing for a new home, car, or business. If you're.

Stocks That Will Get You Rich

The main reason the stock market has been such a tremendous wealth generator is the effect of compound interest. While you can make short-term profits in the. Let us take a look at how investors can make the most of stock markets to become rich through long-term wealth creation. You can become rich but it will take some time and even years. Regarding stocks to invest, which location are you based in? You can still invest. The main reason why is due to the absolute amount of money you need to risk to get rich in stocks. Even if your $5, stock investment goes up 50%, that's only. you must purchase a complete stock and not a part of it. This means you will have to deploy a considerable amount of money to buy all the 50 stocks in NIFTY The power of choice. Invest on your own, trade with thinkorswim®, and get full-service wealth management all in one place. Almost everyone should own stocks or stock-based investments like exchange-traded funds (ETFs) and mutual funds (more on those in a bit). Stocks have. Keep in mind that when investing in stocks, you shouldn't just be throwing your money at random individual stocks. A tried-and-true strategy is to invest in. No matter your income, you will get rich off stocks as long as you start investing early, keep investing, and never sell. The main reason the stock market has been such a tremendous wealth generator is the effect of compound interest. While you can make short-term profits in the. Let us take a look at how investors can make the most of stock markets to become rich through long-term wealth creation. You can become rich but it will take some time and even years. Regarding stocks to invest, which location are you based in? You can still invest. The main reason why is due to the absolute amount of money you need to risk to get rich in stocks. Even if your $5, stock investment goes up 50%, that's only. you must purchase a complete stock and not a part of it. This means you will have to deploy a considerable amount of money to buy all the 50 stocks in NIFTY The power of choice. Invest on your own, trade with thinkorswim®, and get full-service wealth management all in one place. Almost everyone should own stocks or stock-based investments like exchange-traded funds (ETFs) and mutual funds (more on those in a bit). Stocks have. Keep in mind that when investing in stocks, you shouldn't just be throwing your money at random individual stocks. A tried-and-true strategy is to invest in. No matter your income, you will get rich off stocks as long as you start investing early, keep investing, and never sell.

More than anything, people manage to stay rich with investing. No one gets rich trading except brokers and invstment bankers. The way you get. New investors should focus on high-quality stocks of companies that have sound financial fundamentals and easy-to-understand business models. Among the stocks. The 10 need-to-knows · With investing, you're taking a risk with your money · A stock market is like a supermarket where you can buy or sell shares · You can make. You can make money on Cash App stocks. Investors can buy and hold or sell stocks once they reach optimal exit prices. Q. How long does it take. Dividend growth stocks as a group have statistically mildly outperformed the S&P for decades too, which doesn't hurt. You can buy shares of companies, those. stocks that can beat them · Read full story. Earnings Watch The drama is Visit a quote page and your recently viewed tickers will be displayed here. Investing in the stock market remains one of the most tangible ways to become a millionaire. It is available to everyone, and it does not require luck, a rich. Thankfully, it doesn't take a lot of money to get started with investing in stocks. Instead, you can buy fractional shares with as much money as you have. At Vanguard, you can invest in many different investment products, including mutual funds, exchange-traded funds (ETFs), stocks, bonds, CDs, and money market. Book overview · The national bestseller · can learn to invest wisely with this bestselling investment system! ·, has shown over 2 million investors the secrets to. Yes, you can get rich off stocks. Investing in the stock market is a proven way to build wealth but it involves things like consistently investing, not selling. That's because this year's underperformers can become next year's outperformers, and if you find a once-stellar stock among the dogs, it may be ripe for a. GOOGL, AMD, MSFT, NVDA, AAPL in that order for me. GOOGL and AMD are reasonably priced in so you can grab more for your buck. I'm sure you're. Getting Started shows you how to put the CAN SLIM System to work for you. Using an easy-to-follow game plan designed for busy people. GOOGL, AMD, MSFT, NVDA, AAPL in that order for me. GOOGL and AMD are reasonably priced in so you can grab more for your buck. I'm sure you're. Merrill Lynch Wealth Management has the financial advisors and expertise to help you achieve your goals at any stage of your life or career. You can hold mutual funds, ETFs (exchange-traded funds), stocks, bonds, and It can take 3 to 7 days for your money to become available for investing. For those looking to take less risk in their portfolios, traditionally safer investments include treasury bonds, money market funds, and “blue chip” stocks that. Make your money work for you. Get the latest news on investing, money, and.

How Much Is One Share Of Disney Stock

Negotiable certificates are actual securities representing underlying share ownership. Like many companies, Disney no longer offers stock certificates. Nasdaq provides the ownership stake information in a company, including the number of shares held by those institutions in a firm, along with recent purchases. Key Data. Open $; Day Range - ; 52 Week Range - ; Market Cap $B; Shares Outstanding B; Public Float B; Beta Top investors of Walt Disney Company stock. Who bought or sold Walt Disney Company this quarter? Fund or Company Name. Shares Held. Valued At. Change in Shares. Earnings for Walt Disney are expected to grow by % in the coming year, from $ to $ per share. Price to Earnings Ratio vs. the Market. The P/E. Walt Disney Co. historical stock charts and prices, analyst ratings, financials, and today's real-time DIS stock price. About Disney (DIS) ; Open. $ ; Price / earnings ratio. x ; Yesterday's range. $ - $ ; Debt / equity. x ; 52 week range. $ - $ stock price multiplied by the number of shares outstanding. Disney market value as of August 30, is $B. Compare DIS With Other Stocks. Disney. Discover historical prices for DIS stock on Yahoo Finance. View daily, weekly or monthly format back to when The Walt Disney Company stock was issued. Negotiable certificates are actual securities representing underlying share ownership. Like many companies, Disney no longer offers stock certificates. Nasdaq provides the ownership stake information in a company, including the number of shares held by those institutions in a firm, along with recent purchases. Key Data. Open $; Day Range - ; 52 Week Range - ; Market Cap $B; Shares Outstanding B; Public Float B; Beta Top investors of Walt Disney Company stock. Who bought or sold Walt Disney Company this quarter? Fund or Company Name. Shares Held. Valued At. Change in Shares. Earnings for Walt Disney are expected to grow by % in the coming year, from $ to $ per share. Price to Earnings Ratio vs. the Market. The P/E. Walt Disney Co. historical stock charts and prices, analyst ratings, financials, and today's real-time DIS stock price. About Disney (DIS) ; Open. $ ; Price / earnings ratio. x ; Yesterday's range. $ - $ ; Debt / equity. x ; 52 week range. $ - $ stock price multiplied by the number of shares outstanding. Disney market value as of August 30, is $B. Compare DIS With Other Stocks. Disney. Discover historical prices for DIS stock on Yahoo Finance. View daily, weekly or monthly format back to when The Walt Disney Company stock was issued.

The price of a security measures the cost to purchase 1 share of a security. For a company, price can be multiplied by shares outstanding to find the market. Shop Disney stock certificates today! Offering the lowest price guarantee on one share stocks of Disney. Shop now! Financials (Next Earnings Date Est.) Annual Quarterly TTM. Per Share Data · DIS's Y Financials All-In-One Screener Stock Ideas Stock List Guru. Walt Disney Company ; Price Momentum. DIS is trading near the bottom ; Price change. The price of DIS shares has decreased $ ; Closed at $ The stock has. $ Buy one share of The Walt Disney Company stock as a gift in just 1 minute. The lucky recipient gets the cool stock certificate and becomes a real. Get the LIVE share price of Walt Disney Company The(DIS) and stock performance in one place to strengthen your trading strategy in US stocks. Walt Disney ; Market Cap. $B ; P/E Ratio (ttm). ; Forward P/E · ; Diluted EPS (ttm). ; Dividends Per Share. Forward P/E 1 Yr. Earnings Per Share(EPS). $ Annualized Dividend. $ Ex Dividend Date. Jul 8, Dividend Pay Date. Jul 25, Current. Share type; Display peers; Trace indices; Markers; Lower part of the graph Disney Earnings Q3 CEO Bob Iger and CFO Hugh Johnston Showcase. The estimated number of people who visited one or more of the websites owned by Walt Disney How many shares outstanding does Walt Disney have? Walt Disney has. Key Stats ; Market CapB ; Shares OutB ; 10 Day Average VolumeM ; Dividend ; Dividend Yield%. The latest closing stock price for Disney as of September 05, is The all-time high Disney stock closing price was on March 08, The. What is Walt Disney Earnings Per Share? The Walt Disney EPS is What Is the Next Walt Disney Earnings Date? In one share of Disney was worth around $ You could own more than 2 shares of Disney stock if your certificates were issued before July. One share is worth $ There was a 3 for 1 split on July 10, and a 10split on 13 June How Many Shares to Buy? Portfolio Diversification · Long Term Investing Key Data Points. Current Price. The most recent price per share for this stock. Stay up to date on the latest The Walt Disney Company (DIS) stock price, market cap, PE ratio and real-time price movements How much is one share of DIS? One. Summary of all time highs, changes and price drops for Walt Disney. Historical stock prices ; 52 Week High, US$ ; 52 Week Low, US$ ; Beta, ; 11 Month. The current price of DIS is USD — it has decreased by −% in the past 24 hours. Watch Walt Disney Company (The) stock price performance more closely on. How To Buy One Real Share of Walt Disney Stock here at kastilbet.site The gift of Disney stock ownership is perfect for baptisms, birthdays, graduation.

1 2 3 4 5