kastilbet.site Market

Market

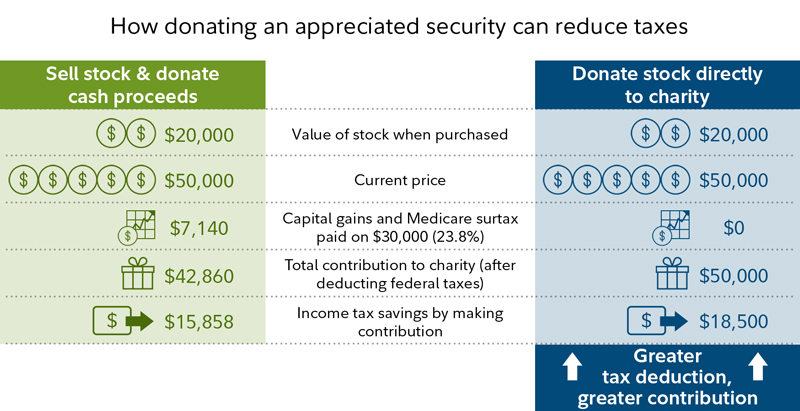

How Much Can I Deduct For Charitable Contributions

Part of figuring out if you should itemize is knowing how much your donations may be worth. The limit for cash donations is generally 60% of adjusted gross. Taxpayers may deduct charitable contributions if they itemize their deductions on Form , Schedule A. The taxpayer must make a voluntary payment and cannot. Taxpayers can deduct charitable contributions by itemizing their deductions using Schedule A (Form ). For non-cash contributions greater than $, the IRS. For donations of appreciated assets, the maximum charitable deduction in is 30% of your AGI. If you gave more than $ in non-cash assets, you'll need to. C corporations are technically the only business structure that can take a deduction when donating to charity. An. LLC is not recognized as a business for. The deduction for cash donations is generally limited to 60% of your federal adjusted gross income (AGI). However, that percentage drops for certain types of. Taxpayers can deduct charitable contributions by itemizing their deductions using Schedule A (Form ). For non-cash contributions greater than $, the IRS. Resident taxpayers subject to the tax may deduct the amount of their charitable donations in excess of $, annually, subject to an annual limit of $, (Except that for you can deduct up to $ per tax return of qualified cash contributions if you take the Standard Deduction. For , this amount is up. Part of figuring out if you should itemize is knowing how much your donations may be worth. The limit for cash donations is generally 60% of adjusted gross. Taxpayers may deduct charitable contributions if they itemize their deductions on Form , Schedule A. The taxpayer must make a voluntary payment and cannot. Taxpayers can deduct charitable contributions by itemizing their deductions using Schedule A (Form ). For non-cash contributions greater than $, the IRS. For donations of appreciated assets, the maximum charitable deduction in is 30% of your AGI. If you gave more than $ in non-cash assets, you'll need to. C corporations are technically the only business structure that can take a deduction when donating to charity. An. LLC is not recognized as a business for. The deduction for cash donations is generally limited to 60% of your federal adjusted gross income (AGI). However, that percentage drops for certain types of. Taxpayers can deduct charitable contributions by itemizing their deductions using Schedule A (Form ). For non-cash contributions greater than $, the IRS. Resident taxpayers subject to the tax may deduct the amount of their charitable donations in excess of $, annually, subject to an annual limit of $, (Except that for you can deduct up to $ per tax return of qualified cash contributions if you take the Standard Deduction. For , this amount is up.

How much of a donation is tax deductible? The limit on the deductibility of cash charitable contributions to an eligible (c)(3) organization as an itemized. There's no charity tax deduction minimum donation amount required to claim a charitable deduction. However, you can only claim certain itemized deductions. In addition, the charitable contribution deduction limit for a gift of cash to a public charity is now back to 60 percent of one's adjusted gross income as the. The limit for charitable deduction of cash donations is 60% of adjusted gross income (AGI). For appreciated assets such as stocks and property, the donation is. Charitable Deductions Generally · 30 percent of the taxpayer's contribution base, or · the excess of 50 percent of the taxpayer's contribution base for the tax. 6. There are limits to how much you can deduct. The rule of thumb is that you can deduct up to 60% of your adjusted gross income through charitable donations. You can deduct your contributions only if you make them to a qualified organization. How to check whether an organization can receive deductible charitable. Federal law limits cash contributions to 60 percent of your federal adjusted gross income (AGI). California limits cash contributions to 50 percent of your. You can deduct charitable contributions from your taxable income—if you follow IRS rules about documenting your gifts. For taxpayers who itemize, the IRS has. You can generally deduct up to 60% of your adjusted gross income (AGI) for donations made to public charities and private foundations. For donations made to. The percentage limit is increased to 60 percent of an individual's contribution base for cash contributions made to public charities in through Your deduction for charitable contributions generally can't be more than 60% of your adjusted gross income (AGI), but in some cases 20%, 30%, or 50% limits may. Part B income does not include dividends, capital gains, or interest (other than interest from MA banks). The charitable deduction is limited to 50% of the. Corporations may not deduct more than 10 percent of their pretax income in a given year but, like individuals, may carry forward excess donations for five years. Noncash Charitable Contributions — applies to deduction claims totaling more than $ for all contributed items. If a donor is claiming over $5, in. The charitable contributions deduction allows taxpayers to deduct donations of cash and property given to qualified charitable organizations. When filing. If you want to take a charitable contribution deduction on your income-tax return, you need to substantiate your gifts. You must have the charity's written. The standard deduction for the tax year is $13, for single filers, $20, for heads of household and, $27, for married couples filing jointly. You can take a tax deduction for charitable donations made to a qualified organization. You may donate between 1% and 2% of your annual income or you could. Those who are charitably inclined and find themselves on the margin between taking the standard deduction or itemizing could maximize their tax benefits by “.

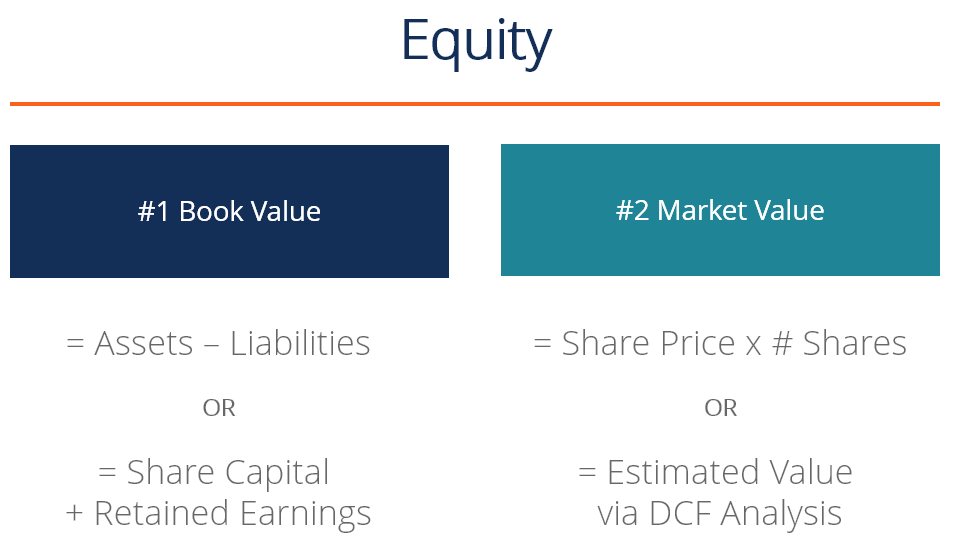

Equity Market Means

What is Equity Market? An equity market is a platform for trading in company shares. Learn the meaning, benefits, & types of equity market with Angel One. Equity can be defined as the amount of money the owner of an asset would be paid after selling it and any debts associated with the asset were paid off. A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on. Primary Share Markets. When a company registers itself for the first time at the stock exchange to raise funds through shares, it enters the primary market. An equity market is a platform that allows companies to raise capital via different investors. A company thus issues stocks that investors or traders purchase. Equity is the amount of capital invested or owned by the owner of a company. The equity is evaluated by the difference between liabilities and assets recorded. Equity can be defined as the amount of money the owner of an asset would be paid after selling it and any debts associated with the asset were paid off. Dow Jones Industrial Average (Dow) - The most commonly used indicator of stock market performance, based on prices of 30 actively traded blue chip stocks. An equity investment is money that is invested in a company by purchasing shares of that company in the stock market. What is Equity Market? An equity market is a platform for trading in company shares. Learn the meaning, benefits, & types of equity market with Angel One. Equity can be defined as the amount of money the owner of an asset would be paid after selling it and any debts associated with the asset were paid off. A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on. Primary Share Markets. When a company registers itself for the first time at the stock exchange to raise funds through shares, it enters the primary market. An equity market is a platform that allows companies to raise capital via different investors. A company thus issues stocks that investors or traders purchase. Equity is the amount of capital invested or owned by the owner of a company. The equity is evaluated by the difference between liabilities and assets recorded. Equity can be defined as the amount of money the owner of an asset would be paid after selling it and any debts associated with the asset were paid off. Dow Jones Industrial Average (Dow) - The most commonly used indicator of stock market performance, based on prices of 30 actively traded blue chip stocks. An equity investment is money that is invested in a company by purchasing shares of that company in the stock market.

OTC markets are trading marketplaces that do not function as traditional stock exchanges. They are decentralized (they don't have a firm physical location) and. Companies list on the stock market to raise capital by by selling their shares to institutional or retail investors. Institutional investors means entities like. A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on. Equity market, often called as stock market or share market, is a place where shares of companies or entities are traded. The market allows sellers and buyers. An equity market is a platform that allows companies to raise capital via different investors. A company thus issues stocks that investors or traders purchase. The equity market is a place for buying and selling stocks and shares of companies. These transactions can occur either over the counter or on stock exchanges. As an asset class, equity plays a fundamental role in investment analysis and portfolio management because it represents a significant portion of many. Exchanges, whether stock markets or derivatives exchanges, started as physical places where trading took place. Some of the best known include the New York. A stock market refers to a market where the buying and selling of shares of publicly traded companies takes place. It is a key component of a market economy. There's no universally accepted definition of a correction, but most people consider a correction to have occurred when a major stock index, such as the S&P The ECM is a subset of the capital market where financial institutions and companies interact to trade financial instruments and raise capital. The stock market refers to public markets that exist for issuing, buying, and selling stocks that trade on a stock exchange or over-the-counter. People buy value stocks in the hope that the market has overreacted and that the stock's price will rebound. Blue-chip stocks are shares in large, well-known. By investing in shares this way, you are taking direct ownership of the underlying asset. This means that if the value of a stock rises, you make a profit. If. In simpler terms, equity is the total amount of money that a shareholder is eligible to receive if all of a company's debts are paid off and its assets. The term “financial market” describes any place or system that provides buyers and sellers the means to trade financial instruments such as bonds, equities. Having a “long” position in a security means that you own the security. Investors maintain “long” security positions in the expectation that the stock will. Equity market and stock market are synonymous. They refer to the exchanges on which shares of public companies are bought and sold. Increasingly, stock exchanges are part of a global securities market. Stock means of disposing of shares. In recent years, as the ease and speed of. The stock market, also known as the stock exchange, is a place where stocks, equities, and other securities and bonds are actively traded. The term 'stock' is.

How To Trade Currency On Etoro

I've recently joined eToro after learning about forex trading elsewhere. When I try to purchase an fx pair, eToro blocks it saying "CFD. How to trade eToro shares · Open a kastilbet.site account, or log in if you're already a customer · Search for the company you want to trade in our award-winning. faq · 1. Choose the currency pair you wish to trade. For example, EUR/USD · 2. Set up the trade by selecting: Buy or sell, depending on your view of the. eToro is a multi-asset investment platform. The value of your investments may go up or down. On eToro, you can trade and invest in the world's most popular. eToro is widely popular globally and boasts a user base totalling 20,,+, making it the best trading app for beginners. It has an app for iOS and Android. under normal market conditions you can buy and sell currency as you Click here to get a free eToro account and open your first trade today! Page. A beginner's guide to trading currencies | PG Page 8. To place a currency trade on etoro, simply: ▫ Login or create an account by going to kastilbet.site The eToro platform operates in USD only. However, you can choose to display your portfolio value in any of the currencies we offer, based on the live exchange. Learn about forex scalping, swing trading and day trading. Discover how each approach works and decide which will best position you to meet your investment. I've recently joined eToro after learning about forex trading elsewhere. When I try to purchase an fx pair, eToro blocks it saying "CFD. How to trade eToro shares · Open a kastilbet.site account, or log in if you're already a customer · Search for the company you want to trade in our award-winning. faq · 1. Choose the currency pair you wish to trade. For example, EUR/USD · 2. Set up the trade by selecting: Buy or sell, depending on your view of the. eToro is a multi-asset investment platform. The value of your investments may go up or down. On eToro, you can trade and invest in the world's most popular. eToro is widely popular globally and boasts a user base totalling 20,,+, making it the best trading app for beginners. It has an app for iOS and Android. under normal market conditions you can buy and sell currency as you Click here to get a free eToro account and open your first trade today! Page. A beginner's guide to trading currencies | PG Page 8. To place a currency trade on etoro, simply: ▫ Login or create an account by going to kastilbet.site The eToro platform operates in USD only. However, you can choose to display your portfolio value in any of the currencies we offer, based on the live exchange. Learn about forex scalping, swing trading and day trading. Discover how each approach works and decide which will best position you to meet your investment.

Invest with the multi-asset platform that revolutionized trading. Join millions of investors worldwide who share their ideas and strategies in a community. With innovative investment tools and a collaborative trading community, eToro empowers millions of users in over countries to trade and invest in a simple. eToro offers cryptocurrency trading on 41 digital currencies (Bitcoin BTC, Ripple XRP, Dash, Neo, etc.) with low trading fees and 0% commissions. Important note. eToro offers the possibility to trade cryptocurrencies, stocks, commodities, forex, indices and ETFs from anywhere in the world. Forex trading works by purchasing currency pairs. When you “buy” a currency pair, you buy the currency expressed in the first part of the pair's ticker and sell. eToro Currency Conversion Fee. eToro only offer trading accounts in US Dollars, which adds to their indirect trading cost revenue stream. Each time a trader. eToro is a social trading and investment network that allows users to trade currencies, commodities, indices, crypto assets, and stocks. It is a multi-asset. Anyone can take advantage of the forex course. You do not need to have a prior understanding of forex or an active eToro account to use this course to learn. trade currency and commodities. They have since expanded to offer stocks and contract for difference (CFD), cryptocurrency, a mobile app, and a social component. You can only use other currency with the balance available on the eToro money account and not on the eToro platform. Upvote 1. Downvote Reply. Unfortunately, eToro does not offer forex trading in the USA. We will of course communicate with our users if we are able to offer such an option in the. Although forex means 'foreign exchange', there is no specific marketplace in which currencies are traded. The forex market is open 24 hours a day, five days a. In this guide, I will delve deeper into forex trading and how to invest in FX pairs using eToro, drawing from my personal experiences and practices on the. With eToro's innovative CopyTrader™, you can automatically copy the moves of other investors. Find investors you believe in and replicate their actions in real-. There are zero conversion fees when trading GBP or EUR-based assets using funds from your GBP or EUR account (eToro Money). Also, please note that conversion. In this guide, we'll delve into the intricacies of forex trading on eToro, providing valuable insights and practical tips for both novice and experienced. However you can get better fx currency conversion rates by using third parties to convert AUD into USD and then deposit it into Etoro. This same situation. You should decide first what assets you want to trade whether it be currencies, commodities, stocks or crypto currencies. Then decide if you. A currency pair is a financial instrument that can be bought and sold on a currency exchange. Each pair is made up of two currencies. The eToro app has all the tools you need to become an investor. Start investing today. INVEST IN STOCKS FROM AROUND THE GLOBE. Choose from thousands of stocks.

Buying 1 Tesla Stock

Is Tesla stock a Buy, Sell or Hold? Tesla stock has received a consensus rating of buy. The average rating score is and is based on 50 buy ratings. The intrinsic value of one TSLA stock under the Base Case scenario is USD. Compared to the current market price of USD, Tesla Inc is Overvalued. It is a good option to buy one Tesla share every month. It is also called a Stock SIP. Tesla has strong financials and good growth prospects. Like other stocks, TSLA shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To. Conclusion: Is TSLA Stock a Good Buy or Sell? Tesla (TSLA) has an AI Score of 10/10 (Strong Buy) because, according to an overall analysis, it has a. Tesla: buy or sell Tesla Stock commission-free with Trading Invest commission-free. Buy and sell fractional shares for as little as £1. Yes, the company could lose value, in which case that single share would lead to a small loss. View the real-time TSLA price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. How to buy Tesla shares (TSLA) · Step 1: Choose a broker · Step 2: Decide how much to invest · Step 3: Review TSLA stock performance and potential · Step 4: Choose. Is Tesla stock a Buy, Sell or Hold? Tesla stock has received a consensus rating of buy. The average rating score is and is based on 50 buy ratings. The intrinsic value of one TSLA stock under the Base Case scenario is USD. Compared to the current market price of USD, Tesla Inc is Overvalued. It is a good option to buy one Tesla share every month. It is also called a Stock SIP. Tesla has strong financials and good growth prospects. Like other stocks, TSLA shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To. Conclusion: Is TSLA Stock a Good Buy or Sell? Tesla (TSLA) has an AI Score of 10/10 (Strong Buy) because, according to an overall analysis, it has a. Tesla: buy or sell Tesla Stock commission-free with Trading Invest commission-free. Buy and sell fractional shares for as little as £1. Yes, the company could lose value, in which case that single share would lead to a small loss. View the real-time TSLA price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. How to buy Tesla shares (TSLA) · Step 1: Choose a broker · Step 2: Decide how much to invest · Step 3: Review TSLA stock performance and potential · Step 4: Choose.

On eToro, you can buy $TSLA or other stocks and pay ZERO commission! Follow Tesla Motors, Inc. share price and get more information. Terms apply. Is Tesla Inc a Good Stock to Buy? Determining whether Tesla Inc—or any stock—is a good buy requires comprehensive analysis. To evaluate its potential, users can. As of 2 March, MarketBeat had the consensus recommendation from analysts for Tesla stock stood at 'hold', with 21 out of 36 analysts rating the stock a buy, Recent price changes and earnings estimate revisions indicate this stock lacks momentum and would be a lackluster choice for momentum investors. Style Scorecard. This step-by-step guide will show how to buy Tesla stock using the five-star-rated platform Fidelity. Fidelity makes it easy to buy stocks. How to buy Tesla stock · Choose a stock trading platform. Use our comparison table · Open an account. Provide your personal information and sign up. · Fund your. Analyst Rating · Buy. % · Hold. % · Sell. %. To compare apples to apples, this means that the cost basis of the initial purchase price should be divided by 15, as one share of Tesla stock in would. 1 D; 5 D; 1 M; 3 M; YTD; 1 Y; 3 Y. $; %. Advanced Charting Compare. Compare to Buy Side from WSJ · WSJ Pro · WSJ Video · WSJ Wine · The Times · Privacy Notice. Thinking of buying or selling Tesla Inc stock that's listed in a currency different from your local one? Use our international stock ticker to check and. $ Buy one share of Tesla Inc stock as a gift in just 1 minute. The lucky recipient gets the cool stock certificate and becomes a real shareholder of the. The company was founded by Jeffrey B. Straubel, Elon Reeve Musk, Martin Eberhard, and Marc Tarpenning on July 1, and is headquartered in Austin, TX. No, you cannot buy Tesla stock directly from the company. You need to have a brokerage account that facilitates the purchase process. What is the Best Stock To. Recent price changes and earnings estimate revisions indicate this stock lacks momentum and would be a lackluster choice for momentum investors. Style Scorecard. Yes, Tesla Inc shares can be bought in India by opening an international trading account with Groww. How to Buy Tesla Inc Shares in India? The amount of money for one share post split (I.e ~) may seem significant to you now however it is not significant in the slightest. However. Tesla - 14 Year Stock Price History | TSLA ; , , , I bought meta in when it crashed as VR was “dead” and every article was talking like Zuck and meta was one foot in the grave. Today, I'm up. Tesla's stock is traded on multiple exchanges around the world. This means that investors have many different opportunities to buy and sell #S-TSLA shares. How to buy Tesla stock · Choose a stock trading platform. Use our comparison table · Open an account. Provide your personal information and sign up. · Fund your.

Best Mortgages Uk

Our mortgage comparison tool shows you the best mortgage rates in the UK, including exclusive deals. Get started today and find your perfect mortgage. The right mortgage isn't as simple as choosing the deal with the best interest rate What is a good credit score for a mortgage UK? There are three. The best UK mortgage rates today ; Nationwide. A two year fixed mortgage · % Fixed for 2 years ; Leek United building Society. A two year variable mortgage. Money hacks. How to get the best interest rate deal on a UK mortgage. Aug 21 EDT mortgages below 4% back on sale in UK. Jul 23 EDT. A. If you don't have that much money available for a deposit then owning your own home can seem a pretty far off prospect. However with a LTV mortgage your dream. We've gathered some key data from our mortgage partner, kastilbet.site to help us identify what we believe to be the best lenders for three-year fixed rate. The best mortgage rate currently available is a five-year fixed-rate deal from Nationwide at %. The best rate among two-year fixed-rate mortgages is %. Use our online mortgage comparison tool to find the best mortgages currently on the market in the UK and to compare mortgage lenders. Mortgage Details. Compare mortgage rates across Remortgaging, Moving Home, First Time Buyer, Buy-to-Let, and Specialist Rates. Use our charts and find the best. Our mortgage comparison tool shows you the best mortgage rates in the UK, including exclusive deals. Get started today and find your perfect mortgage. The right mortgage isn't as simple as choosing the deal with the best interest rate What is a good credit score for a mortgage UK? There are three. The best UK mortgage rates today ; Nationwide. A two year fixed mortgage · % Fixed for 2 years ; Leek United building Society. A two year variable mortgage. Money hacks. How to get the best interest rate deal on a UK mortgage. Aug 21 EDT mortgages below 4% back on sale in UK. Jul 23 EDT. A. If you don't have that much money available for a deposit then owning your own home can seem a pretty far off prospect. However with a LTV mortgage your dream. We've gathered some key data from our mortgage partner, kastilbet.site to help us identify what we believe to be the best lenders for three-year fixed rate. The best mortgage rate currently available is a five-year fixed-rate deal from Nationwide at %. The best rate among two-year fixed-rate mortgages is %. Use our online mortgage comparison tool to find the best mortgages currently on the market in the UK and to compare mortgage lenders. Mortgage Details. Compare mortgage rates across Remortgaging, Moving Home, First Time Buyer, Buy-to-Let, and Specialist Rates. Use our charts and find the best.

Becoming a homeowner is a big deal. Looking for the best first-time buyer You've never owned a residential property either in the UK or abroad, or. Compare the best mortgage rates across the whole market – thousands of mortgages from over 90 lenders UK. Here are the stamp duty rates in the UK as from 1. Compare mortgages. Find the best mortgage deals without affecting your credit score Get free expert advice from L&C, the UK's leading fee-free broker. UK Mortgage rates are at all time lows! ; Initial rate: %. Rate type: 5 year fixed. Monthly cost: £ per month. Product fee: £ Overall cost for. NatWest continues to offer the best remortgage rate for a 5 year fix this month but they have dropped it from % last month. Best 10 year fixed rate mortgage. We look at what's happening with UK mortgage rates and if they'll go down in Equity release · Remortgaging or equity release: which is best? If you need. It lists the best interest rates from the current 5 mortgage lenders with the lowest rates based on the current average loan-to-value and property value. Mortgages are much more expensive than they were a couple of years ago, but the Bank of England's decision to cut its base rate from % to 5% could bring. Best mortgage lenders for bad credit · Precise Mortgages · The Mortgage Lender · Kensington Mortgages · Aldermore Bank · Magellan Homeloans · Pepper Money · Together. You've never owned a residential property either in the UK or abroad, or Once the deal has ended, it's usually best to switch mortgages to avoid. In this article, we share the best fixed-rate, tracker, buy-to-let and first-time buyer mortgage rates available in the UK. Fixed rate mortgages. A fixed rate mortgage, as the name suggests, has a fixed interest rate for a set term. · Tracker mortgages · Offset mortgages · Capped. Find the lender with the leading rates for million pound plus mortgages or use our £1 million+ mortgage calculator. ; HSBC for Intermediaries · % · Five years. mortgage customers through the cost of living crisis. close. HSBC UK · Mortgages. Rates. Find the best mortgage rate for you. Existing HSBC mortgage. Already. Why you can trust Forbes Advisor's ratings · Our pick of the best fixed rate deals · Top 2-year fixed rate mortgages · BM Solutions · Santander · Halifax. Getting your best mortgage rate with Mojo Mortgages · Tell us your mortgage information · Compare with Mojo's deal table · Get your best mortgage deal with an. Compare mortgage rates and find the mortgage deal that's best for you. Check what your interest rate and monthly payments could be. The best mortgage rate could save you 's · We are a whole of market award winning mortgage broker with access to + lenders, these are some of the lenders. Discover the Best Fixed Rate Mortgages from the UK's top providers. Compare Fixed Rate Terms, LTV and other options to suit your needs. Find the lender with the leading rates for million pound plus mortgages or use our £1 million+ mortgage calculator.

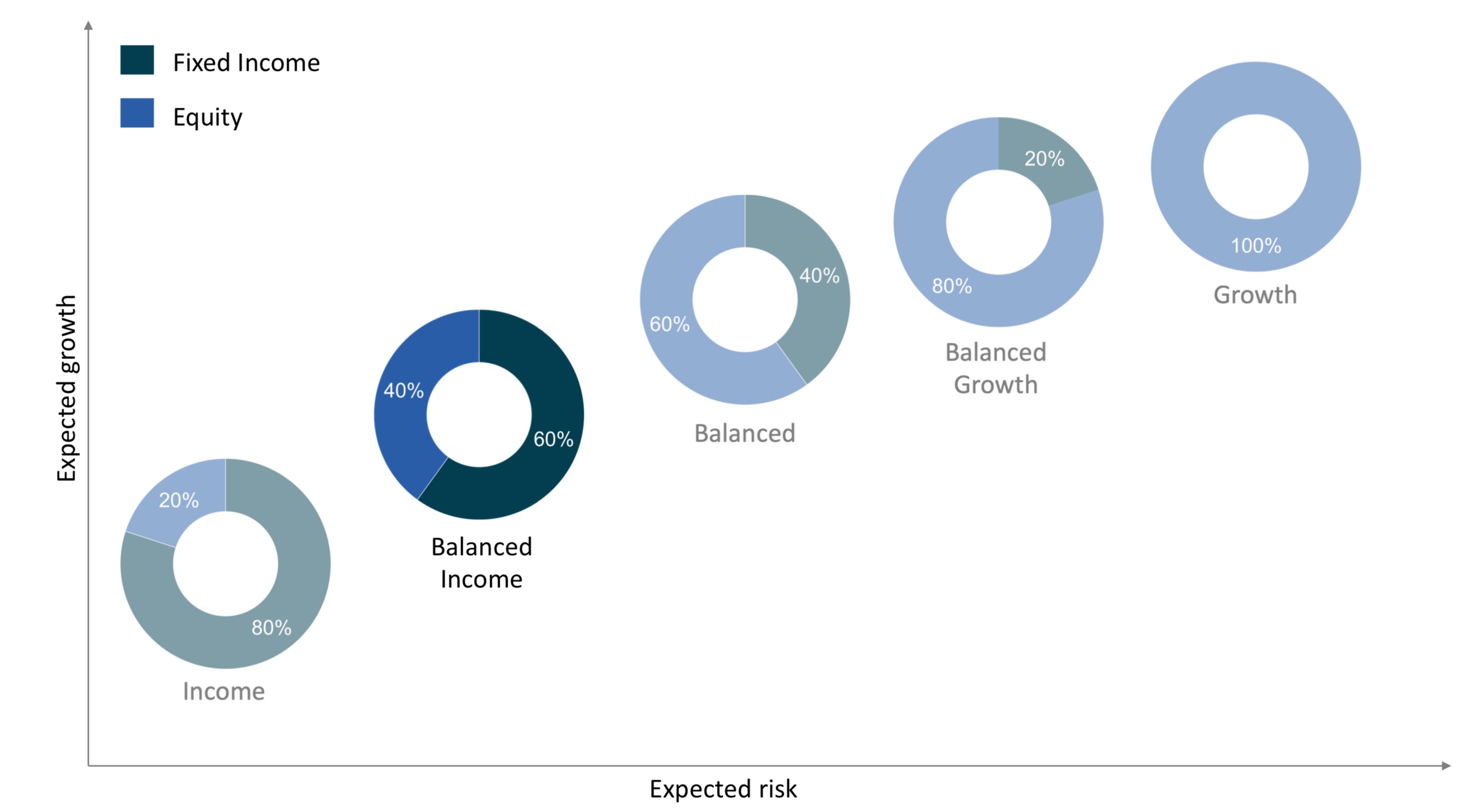

Growth And Income Etf

ETF strategies that look beyond traditional fixed income, offering solutions for investors seeking to increase or diversify the yield potential of their. U.S. Equity ETFs ; Focused Dynamic Growth ETF · FDG. Growth ; U.S. Quality Growth ETF · QGRO. Growth ; Sustainable Growth ETF · ESGY. Growth ; Low Volatility ETF · LVOL. Seeks a high total return through a combination of current income and capital appreciation. Normally investing a majority of assets in common stocks with a. A growth and income fund is class of mutual fund or exchange-traded fund (ETF) that has a dual strategy of both capital appreciation (growth) and current. Core ; NDIV · Amplify Natural Resources Dividend Income ETF, $, $14,,, % ; QDVO · Amplify CWP Growth & Income ETF, $, $5,,, %. One of the best income ETFs with high return to expense ratios is the iShares Core High Dividend ETF (HDV). This ETF tracks the Morningstar Dividend Yield. A unit investment trust that seeks income and above-average capital appreciation by investing in a diversified portfolio of exchange-traded funds. BDIV, AAM Brentview Dividend Growth ETF, 07/30/, %, $ SPDV, AAM S&P High Dividend Value ETF, 11/28/, %, $ Click to see more information on Aggressive Growth ETFs including historical performance, dividends, holdings, expense ratios, technicals and more. ETF strategies that look beyond traditional fixed income, offering solutions for investors seeking to increase or diversify the yield potential of their. U.S. Equity ETFs ; Focused Dynamic Growth ETF · FDG. Growth ; U.S. Quality Growth ETF · QGRO. Growth ; Sustainable Growth ETF · ESGY. Growth ; Low Volatility ETF · LVOL. Seeks a high total return through a combination of current income and capital appreciation. Normally investing a majority of assets in common stocks with a. A growth and income fund is class of mutual fund or exchange-traded fund (ETF) that has a dual strategy of both capital appreciation (growth) and current. Core ; NDIV · Amplify Natural Resources Dividend Income ETF, $, $14,,, % ; QDVO · Amplify CWP Growth & Income ETF, $, $5,,, %. One of the best income ETFs with high return to expense ratios is the iShares Core High Dividend ETF (HDV). This ETF tracks the Morningstar Dividend Yield. A unit investment trust that seeks income and above-average capital appreciation by investing in a diversified portfolio of exchange-traded funds. BDIV, AAM Brentview Dividend Growth ETF, 07/30/, %, $ SPDV, AAM S&P High Dividend Value ETF, 11/28/, %, $ Click to see more information on Aggressive Growth ETFs including historical performance, dividends, holdings, expense ratios, technicals and more.

An actively managed portfolio of diverse, growth, and income generating securities can provide a solid, core position for investors' income needs. Systematic. The BMO Growth ETF is designed to provide long-term capital appreciation by investing in global equity and fixed income ETFs. The ETF will rebalance. Offering another way to tap into the collective expertise of our long tenured and experienced Growth Equity Strategies and Short Duration investment teams. Growth Moat Investing Multi-Asset Income Municipal Bonds Sustainable Investing Taxable Fixed Income Technology. I am interested in Alternative Income. The Morningstar Income and Growth ETF Asset Allocation Portfolio seeks to provide investors with current income and capital appreciation. Strategy. The. Harvest Premium Yield Treasury ETF · Distribution. $ ; Harvest Healthcare Leaders Income ETF · Yield. $ ; Harvest Tech Achievers Growth & Income ETF · Yield. Seeks to provide a high level of current income. The Fund's secondary objectives are to seek growth of income and capital. Active. Factsheet. ETF cash flows · Investment tools. Resources. Fund literature · Total return Income return[4], Total return[5], Benchmark[1]. , —, —, —, —, —, —, —, —. Using a flexible, well-diversified fixed income approach, JPMorgan Income ETF seeks to maximize income for a prudent level of risk. Subtrend growth remains. 10 Best Growth ETFs by AUM, Expenses and Long-Term Performance ; IVW · iShares S&P Growth ETF, $B ; SCHG · Schwab U.S. Large-Cap Growth ETF, $B. Growth and High Income Potential: Seeking capital appreciation from growth-oriented stocks, with high monthly income from option premiums and dividends. The iShares Diversified Monthly Income ETF seeks to provide a consistent monthly cash distribution, with the potential for modest long-term capital growth. Amplify ETFs deliver expanded investment opportunities for growth, capital preservation, and income-focused investors. The iShares Core Growth Allocation ETF seeks to track the investment results of an index composed of a portfolio of underlying equity and fixed income funds. Harvest Tech Achievers Growth & Income ETF (HTA) pays high monthly cashflow and holds some of the largest tech companies in the world. By maintaining exposure to stocks, investors can access growth from equity markets while relying on dividends for income with equity income ETFs. ETFs may yield investment results that, before expenses, generally correspond to the price and yield of a particular index. There is no assurance that the price. An actively managed transparent ETF, JGRO combines two time-tested, bottom-up fundamental approaches seeking underappreciated growth opportunities. NYLI Growth ETF Allocation Fund seeks long-term growth of capital and, secondarily, current income. SSGA Growth and Income ETF Portfolio. Risk Statistics (03/31/24). Fund. Peer Bmrk*. Alpha (%). N/A. Beta. N/A. R² (%).

Ankr Web 3.0

Ankr was founded in by Chandler Song and Ryan Fang, with a mainnet launch in It offers a suite of Web3 (AKA Web ) tools that help developers. 1. How does ANKR cryptocurrency work? chevron_down. ANKR makes accessing Web easy as they offer distributed, a multi-cloud blockchain infrastructure for one. Ankr is a Web infrastructure provider that offers a globally distributed network of nodes for multi-chain access across 40+ blockchains. Founded in by UC Berkeley graduates Chandler Song and Ryan Fang, Ankr Network is a decentralized Web infrastructure provider for an array of. Ankr makes accessing Web easy. We offer distributed, multi-cloud blockchain infrastructure for one-click node deployment and management as well as. Ankr Network have raised a total of $ M in 6 completed rounds: Private, Token Launch and 4 more At the moment Market Cap is $ M, ANKR Token Price. The ANKR token can be used for staking, voting on governance proposals, and as a payment method for accessing services on the ANKR network, such. The term “Web ” was coined by Ethereum co-founder Gavin Wood shortly after Ethereum launched in Core ideas of Web3. Although. Web = Web3, in the context of Ethereum, refers to decentralized So ankr's network / protocol incorporates the ankr token to. Ankr was founded in by Chandler Song and Ryan Fang, with a mainnet launch in It offers a suite of Web3 (AKA Web ) tools that help developers. 1. How does ANKR cryptocurrency work? chevron_down. ANKR makes accessing Web easy as they offer distributed, a multi-cloud blockchain infrastructure for one. Ankr is a Web infrastructure provider that offers a globally distributed network of nodes for multi-chain access across 40+ blockchains. Founded in by UC Berkeley graduates Chandler Song and Ryan Fang, Ankr Network is a decentralized Web infrastructure provider for an array of. Ankr makes accessing Web easy. We offer distributed, multi-cloud blockchain infrastructure for one-click node deployment and management as well as. Ankr Network have raised a total of $ M in 6 completed rounds: Private, Token Launch and 4 more At the moment Market Cap is $ M, ANKR Token Price. The ANKR token can be used for staking, voting on governance proposals, and as a payment method for accessing services on the ANKR network, such. The term “Web ” was coined by Ethereum co-founder Gavin Wood shortly after Ethereum launched in Core ideas of Web3. Although. Web = Web3, in the context of Ethereum, refers to decentralized So ankr's network / protocol incorporates the ankr token to.

This is a big step for Ankr in becoming a community service that the growing Web movement will rely on. What's The Ankr Public RPC? The. Web crypto wallets like MetaMask enable users to interact with dApps and Web platforms. These will span the Metaverse and. WatchData specializes in blockchain technology and provides infrastructure and API services for Web applications. The company offers a suite of tools. Ankr is a globally distributed team of entrepreneurs, creators, and engineers who believe in using tech to build a better web and a better world. We're spread. Ankr makes accessing Web easy. Ankr offers distributed, a multi-cloud blockchain infrastructure for one-click node deployment and management as well as. Ankr is a Web infrastructure provider that offers a globally distributed network of nodes for multi-chain access across 40+ blockchains. Ankr's innovative solutions facilitate the transition to a decentralized and Web powered future, ensuring that the benefits of blockchain technology are. ANKR is a Web infrastructure provider and makes accessing Web easy. ANKR offers access to not just one, but more than forty blockchains through a. Ankr makes accessing Web easy. We offer distributed, multi-cloud blockchain infrastructure for one-click node deployment and management as well as. From Ankr's point of view, DeFi is on track to become the financial system for the web movement. ETH2. ETH2 is a set of upgrades that improve the. Ankr is a global, distributed network of nodes across 50+ proof-of-stake chains. Ankr brings two movements together: web3 and decentralized finance (DeFI). Ankr is well-positioned to be one of the top 3 Web infrastructures due to its unique features and experienced team. Ankr's blockchain nodes. Web because it is open, trustless, and permissionless. Ankr provides Web infrastructure for individuals, developers, and enterprises. Node infrastructure, staking, and DeFi to make developing and earning easy. SoftwareFinanceAPICryptocurrencyBlockchainBuilding TechnologyWeb Web is the reactive solution to significant challenges in previous versions of the internet Ankr has never been more thrilled to release. Ankr is a global, distributed network of nodes across 50+ proof-of-stake chains. Ankr brings two movements together: web3 and decentralized finance (DeFI). ANKR is an Ethereum-based token that powers Ankr, a Web infrastructure and multichain staking DeFi platform. ANKR enables a multichain platform to allow. Matt zamudio. Home · Blog · E-Mail. ANKR. Connecting users to web the ankr app. I worked with Ankr to design their trademark web app, which allows users to. Ankr enhances RaaS with ankrETH to simplify gas fees and maximize staking rewards for developers. Harness the power of innovation now! kastilbet.sitek is currently an active website, according to alexa, ankr Website Keywords: Ankr; Multi-Chain; Staking; DeFi Fixed Income; API; Nodes; Web

Swiss Bank Interest

The Swiss National Bank reduced its key policy rate by 25 bps to % in June , following a similar move in the previous meeting. U.S. citizens and residents with a financial interest in, or signatory or other authority over any foreign financial accounts must file on Form and Form TD. Current interest rates for private clients. 1) Debit interest: % (for a UBS Personal Account for Young People upon reaching the age of majority). The decline in Swiss deposits held by countries with tax rates on interest income below 15% was not more pronounced than for countries with tax rates above 15%. The benchmark interest rate in Switzerland was last recorded at percent. Interest Rate in Switzerland averaged percent from until , reaching. economic data series with tags: Switzerland, Interest Rate. FRED: Download, graph, and track economic data Federal Reserve Bank of St. Louis, One Federal. The SNB analyzes developments on the financial markets and in the area of financial market infrastructure. It takes an in-depth look at the Swiss banking. By remunerating sight deposits, the SNB influences the interest rate level on the money market, so that the secured short-term Swiss franc money market rates. Deposit interest rate (%) - Switzerland from The World Bank: Data. The Swiss National Bank reduced its key policy rate by 25 bps to % in June , following a similar move in the previous meeting. U.S. citizens and residents with a financial interest in, or signatory or other authority over any foreign financial accounts must file on Form and Form TD. Current interest rates for private clients. 1) Debit interest: % (for a UBS Personal Account for Young People upon reaching the age of majority). The decline in Swiss deposits held by countries with tax rates on interest income below 15% was not more pronounced than for countries with tax rates above 15%. The benchmark interest rate in Switzerland was last recorded at percent. Interest Rate in Switzerland averaged percent from until , reaching. economic data series with tags: Switzerland, Interest Rate. FRED: Download, graph, and track economic data Federal Reserve Bank of St. Louis, One Federal. The SNB analyzes developments on the financial markets and in the area of financial market infrastructure. It takes an in-depth look at the Swiss banking. By remunerating sight deposits, the SNB influences the interest rate level on the money market, so that the secured short-term Swiss franc money market rates. Deposit interest rate (%) - Switzerland from The World Bank: Data.

The Swiss National Bank is the central bank of Switzerland, responsible for the nation's monetary policy and the sole issuer of Swiss franc banknotes. economic data series with tags: Switzerland, Interest Rate. FRED: Download, graph, and track economic data Federal Reserve Bank of St. Louis, One Federal. Interest rates and exchange rates, July kastilbet.site Current interest rates and exchange rates ; SNB policy rate % valid from ; Interest rate on sight deposits up to threshold % valid from SNB policy rate | Overview of the current and historical interest rates of the Swiss Central Bank. Switzerland Interest Rate Decision ; Actual: % ; Forecast: % ; Previous: %. The Swiss National Bank Is Looking Swish, Cutting Interest Rates Before Its Peers What's going on here? The Swiss National Bank (SNB) bucked expectations by. Historically speaking, we are currently in a relatively high interest rate environment with a key interest rate of percent, following a period shaped by. SARON can be seen as the average interest rate for loans issued in Swiss Francs (CHF) with a maturity of 1 day (overnight). Swiss Franc interest rate derivatives · Credit Suisse International · The Royal Bank of Scotland plc · Credit Suisse Securities (Europe) Limited · JPMorgan Chase. It probably won't go down for a long while, and indeed will probably still increase at least more times. The reference rate is still. In so doing, it seeks to keep the short-term Swiss franc money market rates close to the SNB policy rate. Both the regular and the other monetary policy. INTEREST RATES ; K, %, %. source: Swiss National Bank. Deposit Interest Rate in Switzerland is expected to be percent by the end of this quarter, according to Trading Economics. The Swiss National Bank (SNB) announces its interest rate decision after each of the Bank's four scheduled annual meetings, one per quarter. In the latest reports, Switzerland Short Term Interest Rate: Month End: 3 Months was reported at % pa in Jul The cash rate (Policy Rate: Month End. In Canton Vaud (Villars) it is % and in in Valais (Verbier, Grimentz, Saas Fee) it is % of the amount borrowed. Interest is payable every quarter on the. ZURICH(Reuters) -The Swiss National Bank cut interest rates on Thursday for the second time running, pointing to easing price pressures that allowed it to. 8) If a UBS Personal Account is managed as a UBS Immo-Smart account, the following interest rates apply: % on balances up to CHF 50,; % on balances. This was enough to improve the industry's median RoE by 60%, and median C/I ratio from 81% to 74%. This uptick may reverse as interest rates fall. driving a.

Is Amex American Express

American Express offers a range of Credit Cards with different rewards and benefits tailored to your lifestyle and interests. American Express cards have consistently among the best credit card offers in Canada. However, they have a reputation for not being accepted by many merchants. Compare all credit cards that American Express has to offer in one place. Discover the best card for you and apply now! American Express is consistently ranked as one of the top credit card providers in Canada, and one of the reasons they are so popular is the perks and rewards. 3. Setup an Amex payment method in your Ecwid Control Panel · Go to Ecwid Control Panel → Payment. · Scroll to Other ways to get paid. · Click Choose payment. Amex - Don't Live Life Without It. From group dinners to concert tickets seamlessly split your American Express purchases with any other Venmo or PayPal user. Explore a wide range of American Express credit cards for benefits and rewards such as points for travel, cash back, and more. Discover more and apply. Amex - Don't Live Life Without It. An American Express card, also known as an “Amex” card, is an electronic payment card branded by the publicly traded financial services company American. American Express offers a range of Credit Cards with different rewards and benefits tailored to your lifestyle and interests. American Express cards have consistently among the best credit card offers in Canada. However, they have a reputation for not being accepted by many merchants. Compare all credit cards that American Express has to offer in one place. Discover the best card for you and apply now! American Express is consistently ranked as one of the top credit card providers in Canada, and one of the reasons they are so popular is the perks and rewards. 3. Setup an Amex payment method in your Ecwid Control Panel · Go to Ecwid Control Panel → Payment. · Scroll to Other ways to get paid. · Click Choose payment. Amex - Don't Live Life Without It. From group dinners to concert tickets seamlessly split your American Express purchases with any other Venmo or PayPal user. Explore a wide range of American Express credit cards for benefits and rewards such as points for travel, cash back, and more. Discover more and apply. Amex - Don't Live Life Without It. An American Express card, also known as an “Amex” card, is an electronic payment card branded by the publicly traded financial services company American.

Make the Most of your Journey with your American Express Platinum Card & Membership Rewards! Browse Amex Platinum Benefits for Travel, Flights, & More! American Express Company, American financial corporation that primarily issues credit cards, processes payments, and provides travel-related services. Don't live life without it. Don't do business without it. Welcome to #AMEXLIFE in Canada. For Customer Service: kastilbet.site Amex mobile Application works perfectly abroad and in USA so you don't feel stuck anywhere in the world. American Express whole process from apply a credit card. Fortunately, American Express is accepted throughout Canada at a variety of stores, restaurants, and service providers: over 90, places in Canada started. Powerfully backing our customers, colleagues and communities. Follow for the latest news from American Express. The Amex EveryDay® Credit Card is the only American Express card without an annual fee that gives you Membership Rewards points although you shouldn't. K Followers, 15 Following, Posts - American Express (@AmericanExpress) on Instagram: "Powerfully backing our customers, colleagues and communities. Browse Amex phone numbers and mailing addresses for personal accounts, business accounts, travel, and membership rewards. Contact American Express today. An American Express Credit Card with no annual fee offers both convenience and value. Find out if a no annual fee Credit Card is for you. American Express Charge Cards · Travel Rewards Cards. Enjoy all the benefits, convenience and security of an American Express® Card - with the added bonus of. The Platinum Card® from American Express is a high-end card that is packed with benefits and a hefty welcome offer. Cardholders can take advantage of numerous. American Express is well-known for its great customer service and credit card products. We decided to evaluate each one and find the best ones of the bunch. The official American Express App for Android allows you to access your Account from anywhere. Track spending & rewards, find offers, review your balance. American Express is one of the leading card issuers in the United States. It's known for its top-notch customer service and some of the best rewards. it has 2% MR earn rate on travel - so does Amex gold. At 3x cheaper annual fees. It has 2% MR earn rate on dining - so does Cobalt (5x up to $ Pay for almost anything with points · Every point counts with Amex · Welcome to American Express® Experiences · Shopping Coverage · World-class service · Exclusive. Powerfully backing our customers, colleagues and communities. Follow for the latest news from American Express. American Express is a multinational payment card services company. Unlike other major card brands, it issues its own cards in addition to processing payments on.

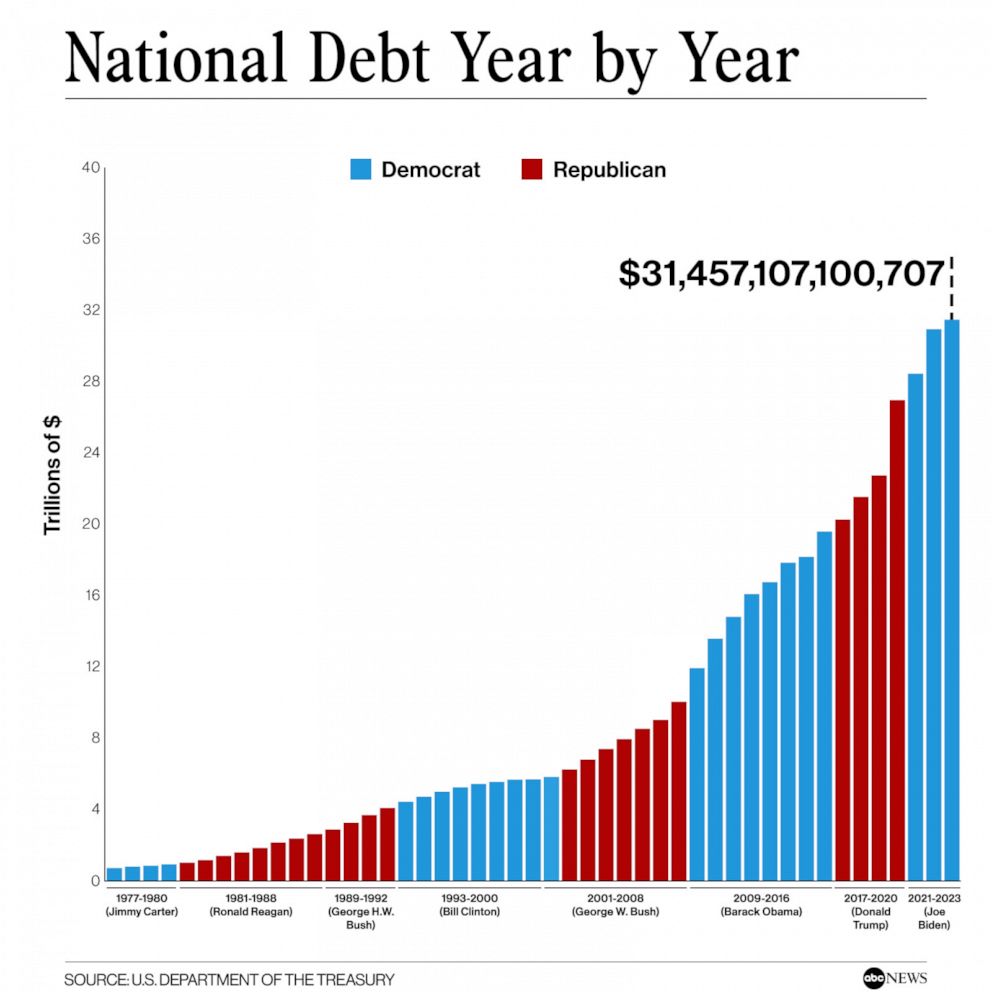

Us Debt Categories

Data Suggestions Based On Your Search · Federal Debt: Total Public Debt as Percent of Gross Domestic Product · Federal Surplus or Deficit [-] · Federal Debt Held. What Is Debt? Debt is something (money, credit, assets) borrowed by one party from another. · What Are the Four Main Types of Debt? · Secured Debt · Unsecured Debt. Total household debt rose by $ billion to reach $ trillion, according to the latest Quarterly Report on Household Debt and Credit. U.S. Debt by Presidential Term · Revolutionary War Kicks Off U.S. Debt · President Andrew Jackson Cuts Debt to Zero · Recovery from the Civil War · Great Depression. While the average American has $90, in debt, this includes all types of consumer debt products, from credit cards to personal loans, mortgages and student. The US Treasury divides all federal spending into three groups: mandatory spending, discretionary spending and interest on debt. Federal Debt Held by Federal Reserve Banks, Federal Debt Held by Foreign and International Investors, Gross Federal Debt, Federal Debt Held by the Public. The United States Treasury offers five types of Treasury marketable securities: Treasury Bills, Treasury Notes, Treasury Bonds, Treasury Inflation-Protected. Debt held by the public is composed of Treasury Bills, Notes, Bonds, Treasury Inflation-Protected Securities (TIPS), Floating Rate Notes (FRNs), Domestic Series. Data Suggestions Based On Your Search · Federal Debt: Total Public Debt as Percent of Gross Domestic Product · Federal Surplus or Deficit [-] · Federal Debt Held. What Is Debt? Debt is something (money, credit, assets) borrowed by one party from another. · What Are the Four Main Types of Debt? · Secured Debt · Unsecured Debt. Total household debt rose by $ billion to reach $ trillion, according to the latest Quarterly Report on Household Debt and Credit. U.S. Debt by Presidential Term · Revolutionary War Kicks Off U.S. Debt · President Andrew Jackson Cuts Debt to Zero · Recovery from the Civil War · Great Depression. While the average American has $90, in debt, this includes all types of consumer debt products, from credit cards to personal loans, mortgages and student. The US Treasury divides all federal spending into three groups: mandatory spending, discretionary spending and interest on debt. Federal Debt Held by Federal Reserve Banks, Federal Debt Held by Foreign and International Investors, Gross Federal Debt, Federal Debt Held by the Public. The United States Treasury offers five types of Treasury marketable securities: Treasury Bills, Treasury Notes, Treasury Bonds, Treasury Inflation-Protected. Debt held by the public is composed of Treasury Bills, Notes, Bonds, Treasury Inflation-Protected Securities (TIPS), Floating Rate Notes (FRNs), Domestic Series.

A line of credit is a loan similar to a credit card, as it is revolving debt. Mortgages. Mortgages, the most common and largest debt in the United States, are. Projections of spending and revenues by category and of deficits and debt held by the public. federal revenues have been added to the data. Jun Tracking the Federal Deficit: March · $ billion (43%) increase in net interest payments on the public debt from rising interest rates and a growing debt. The second is Net National Debt which is the net debt incurred by the Exchequer after taking account of cash and other financial assets. Gross National Debt is. The national debt is the total that a country owes to its creditors. This includes debt held by the public and intragovernmental debt in the United States. The debtor must also file a certificate of credit counseling and a copy of any debt Section sets forth 10 categories of unsecured claims which. What is a discharge in bankruptcy? A bankruptcy discharge releases the debtor from personal liability for certain specified types of debts. What Are the Different kinds of Debt? · Credit Card Debt · Mortgages · Auto Loans · Student Loans · Medical Debt · Related Content. Public debt 4 Indicators, - · Central Government Debt · General Government Debt · Nonfinancial Public Sector Debt · Public Sector Debt. Gross Federal Debt: That's the gross amount of debt outstanding issued by the US Treasury. “Debt held by the public” and “debt held by federal government. Debt Types · General obligation (GO) debt is secured by the full faith and credit of the local government issuing the debt. · Revenue debt is different from GO. * As of August 1, , the U.S. Treasury's official figure for the debt of the federal government is $ trillion, or more precisely, $35,,,,[9]. Households Debt in the United States decreased to percent of GDP in the fourth quarter of from percent of GDP in the third quarter of General government debt is the gross debt of the general government as a percentage of GDP. Debt is calculated as the sum of the following liability categories. Local governments issue two main types of debt: tax (general obligation or GO) and revenue. The most recent U.S. Census Bureau data for local debt outstanding. Components of U.S. Government Debt · Treasury bills (less than 1-year maturity) · Treasury notes (1 to 10 years maturity) · Treasury bonds (greater than 10 years. In the United States, the debt ceiling or debt limit is a legislative limit on the amount of national debt that can be incurred by the U.S. Treasury. Household Debt Service and Financial Obligations Ratios · Mortgage Debt Major types of credit, by holder. Revolving, 1,, , 1,, 1, Table —Composition of Outlays: – · Table —Federal Debt at the End of Year: – Table —Outlays by Budget Enforcement Act Category in. Note: Figures represent nominal values in current US$. Public debt refers to general government domestic and external debt throughout the document. General.

1 2 3 4 5 6