kastilbet.site Tools

Tools

How To Take Payments On My Website

kastilbet.site offers a full payment infrastructure that's easy to set up, even if it's your first time accepting payments online. With our no-code solutions, you don'. Paymentwall is a global payment provider that allows you to process credit card payments and local payment methods in countries and territories. Integrate accepting payments on website such as credit card & debit now. Set up a payment gateway on your website with the following options. The Clover Hosted Payment Page (HPP) is a secure and customizable checkout page that makes it easy to accept credit card payments online or from your website. QuickBooks Payments lets small businesses accept payments online from anywhere. Accept, process, and manage payments online with our merchant services here. Design your own checkout % as you want. We have made a solution enabling you to make a custom payment form without having to deal with saving card details. You'll just need to confirm a little info about your business and link a bank account to start accepting the most popular payment methods. What type of. Types of online payment systems. There are two main ways to take payments from customers online: credit/debit cards and account-to-account payments. If you're. How do I use GoDaddy Payments to accept payments on my website? kastilbet.site offers a full payment infrastructure that's easy to set up, even if it's your first time accepting payments online. With our no-code solutions, you don'. Paymentwall is a global payment provider that allows you to process credit card payments and local payment methods in countries and territories. Integrate accepting payments on website such as credit card & debit now. Set up a payment gateway on your website with the following options. The Clover Hosted Payment Page (HPP) is a secure and customizable checkout page that makes it easy to accept credit card payments online or from your website. QuickBooks Payments lets small businesses accept payments online from anywhere. Accept, process, and manage payments online with our merchant services here. Design your own checkout % as you want. We have made a solution enabling you to make a custom payment form without having to deal with saving card details. You'll just need to confirm a little info about your business and link a bank account to start accepting the most popular payment methods. What type of. Types of online payment systems. There are two main ways to take payments from customers online: credit/debit cards and account-to-account payments. If you're. How do I use GoDaddy Payments to accept payments on my website?

Accept payments for goods or services directly through your site. Wix offers different payment methods and providers depending on your location. Why Should Your Website Accept Online Payments? · Overview of SamCart and Its Payment Processing Features · Setting Up SamCart Payments: Step-by-Step Guide. Google Pay helps your customers check out seamlessly. Whether with their phones in-store or with a click on your website, Google Pay makes it easy. This will allow you to receive payments from the customer. Merchant accounts will typically charge you per transaction as well. This is probably the only way. Providing your bank account information on your invoices and requesting they pay by electronic transfer that they. Keep payment info and business data safe · 3D Secure checkouts · PCI-compliant servers · Payment data encryption. Accept credit cards online, by phone, by payment link or with pre-built payment integrations with leading e-commerce platforms, virtual terminal and a payment. Add a Buy Now or Donate button to your website. Customize with rules-based filters and tools to suit your business model. Keep card information up-to-date. This should take about a minute. Please take no further action while you This website requires that JavaScript be enabled. Please enable JavaScript. Save your payment information, and we'll autofill your saved card details, addresses, and phone numbers for all future purchases on Link-enabled sites. Let your customers choose how they pay. Offer a suite of convenient payment options on your website. Make purchasing easier for your customers. Usually, all you'll need to do to accept online payments is to add the payment processor's plugin or an API module that's designed for your shopping cart. If you use Hostinger Website Builder to run your online store and want to accept bank card payments, you may use PayPal, Stripe, or both. There are a variety of ways to accept credit card payments on your website, but many of them require extensive technical ability or paying a premium for online. Accept payments at your counter or on the go. It's easy to get started. Try the Square POS app on your phone or pick from a range of hardworking hardware. Learn. An easy and efficient way to accept online payments on your website is through a payment gateway. A payment gateway will help you accept. Square Online is automatically configured to use Square's payment processor to accept payments during the checkout flow of your site. No additional setup is. We take the frustration out of online payments · A single, flexible partner for full-stack payments · Accept payments online, from anyone, anywhere · Break away. Open an account first. Set up a business account so you can accept payments. Just follow PayPal's instructions, it's simple to do. No Website? No Problem · Utilising Third-Party Platforms · Utilising Social Media Platforms · Utilising Online Marketplaces · Accepting payments via QR code.

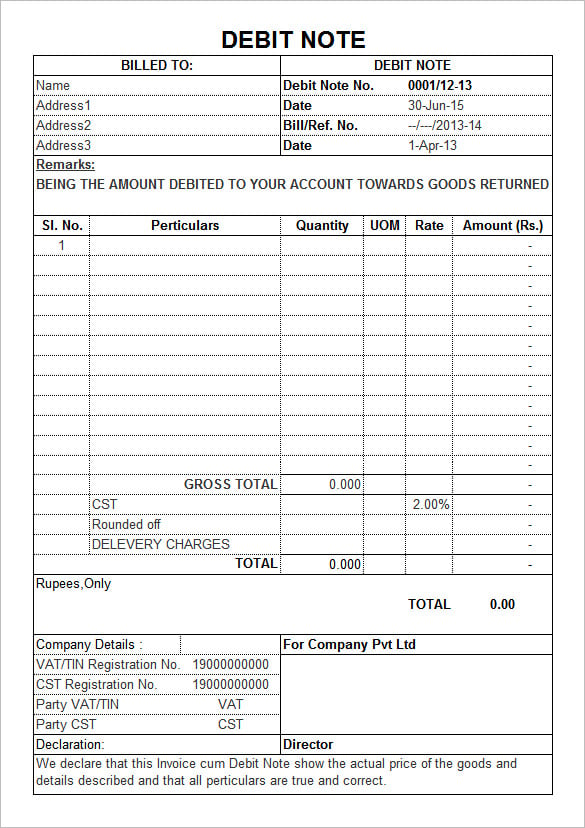

Debit Memos

Debit memo, also referred to as debit note, is a formal document issued by a seller (or service provider) to a customer increasing the customer's. I just lost all my money in my checking account (around $) due to a "memo debit". First of all, I would like to hear your guys onions/thoughts on what. A debit memo is a document issued by a seller or service provider to notify a business customer of a debit or deduction from their account. DAR (Accounts Receivable Adjustment) · Booking violation penalties – A debit memo is issued because a booking violation occurred. · Fare adjustments – A debit. Air Canada will respond, on average, within 15 business days of receipt. If you disagree or require clarification of a debit memo (DM), or a credit memo (CM). Debit memos serve as formal records of financial transactions and are essential for maintaining accurate accounts and clear communication between businesses. A debit memo on a company's bank statement refers to a deduction by the bank from the company's bank account. Encourage training for employees (from ARC, IATA and GDSs) including training on fare rules, refunds, exchanges, booking and ticketing. Use past debit memos as. A customer balance can be adjusted using Credit and Debit Memos. Debit Memo increases a customer's debt, Credit Memo decreases it. Debit memo, also referred to as debit note, is a formal document issued by a seller (or service provider) to a customer increasing the customer's. I just lost all my money in my checking account (around $) due to a "memo debit". First of all, I would like to hear your guys onions/thoughts on what. A debit memo is a document issued by a seller or service provider to notify a business customer of a debit or deduction from their account. DAR (Accounts Receivable Adjustment) · Booking violation penalties – A debit memo is issued because a booking violation occurred. · Fare adjustments – A debit. Air Canada will respond, on average, within 15 business days of receipt. If you disagree or require clarification of a debit memo (DM), or a credit memo (CM). Debit memos serve as formal records of financial transactions and are essential for maintaining accurate accounts and clear communication between businesses. A debit memo on a company's bank statement refers to a deduction by the bank from the company's bank account. Encourage training for employees (from ARC, IATA and GDSs) including training on fare rules, refunds, exchanges, booking and ticketing. Use past debit memos as. A customer balance can be adjusted using Credit and Debit Memos. Debit Memo increases a customer's debt, Credit Memo decreases it.

When a supplier sends you a credit, enter the voucher as a debit memo. The credit is applied to open vouchers when you issue payment to the supplier. In this article, we'll walk through the ins and outs of credit and debit memos, explain their differences in detail, and show you how they're used in everyday. Carbonless Online Printing Debit/Credit Memo Unit Set - x 7 - 3 Part [DCM] - Debit/Credit Memo - Unit SetDCM - " x 7" - 3 PartImprint Area. Description. Debit memos are transactions created by Kroger associated to a supplier invoice, reducing what they pay you. There is typically very little detail. Debit memos may be issued whenever an agent fails to follow the rules of the fare or makes an error in booking or ticketing. Below are some guidelines to help. JetBlue will issue a debit memo in the amount of the fare plus a $50 Service Charge for any changes or cancellations on Blue Basic fares. Upon payment of the. Debit memos are usually created in Accounts Payable to remove or adjust open items. Answer: Debit memos can be used for many purposes: Creating a Debit Memo. A debit memo, also known as a debit note, is a document issued by a seller to notify a buyer about existing debt obligations. A/P Debit Memo. An A/P debit memo behaves in the same manner as an A/P invoice. You use A/P debit memos to document debts to your supplier that are not part of. Debit memos serve as formal records of financial transactions and are essential for maintaining accurate accounts and clear communication between businesses. A debit memo is a formal document that increases the amount owed by a buyer to a seller. It provides transparency for upward adjustments and ensures accurate. Enter a credit or debit memo to record a credit for goods or services purchased. Credit/debit memos are netted with basic invoices at payment time. A debit memo serves as a notification of a debit from your account. The bank will automatically debit your account. In a B2B scenario, a debit memo is a form or. Use. You may need to create credit memos for various reasons (for example, because of defective goods or because you have overcharged a customer). Similarly. Debit note, also known as a debit memo or memorandum, is a notification of a debit made on a recipient's account in the books of a sender. For example, if the bank statement shows a debit memo of $25 for a service charge, it means that the company's general ledger Cash account will need an entry. A Debit Memo is a document raised by the accounts to increase the value of Accounts Receivables without effecting the original Invoice Value. The system uses. Welcome to the Billing and Debit Memos lesson. This lesson covers the basics of Billing and Debit Memos in GFEBS. It is intended that after this lesson you. Use a debit memo to increase the invoice balance. If the invoice has a full balance, you cannot issue a debit memo. Agencies must have all debit memorandums processed according to the AA Memo—FLAIR Fiscal-Year. Closing. All debit memorandums that come through the bank as.

5 Cash Back Restaurant Credit Card

Chase Freedom Flex℠ The Chase Freedom Flex credit card offers 5% cash back in select categories such as gas stations, grocery stores, and select online. Travel Benefits: Unlimited 5% total cash back on travel purchased through Chase Ultimate Rewards, No Foreign Transaction Fees and Trip Cancellation/Trip. Earn cash back for every purchase. Earn 5% cash back on up to $1, on combined purchases in bonus categories each quarter you activate. Plus, earn 5% cash. Earn 4% on gas station purchases, 3% on dining purchases at restaurants, and 2% on grocery store purchases for the first $8, in combined purchases in. Get up to 5% cash back on purchases. Apply Now. Visa Signature. For members who want the most out of life, our premier credit card, Redstone's Visa Signature. Earn unlimited 3% cash back on dining, entertainment, popular streaming services & at grocery stores · $0 annual fee · Earn $ · Low intro APR · Earn 5% · Earn 3%. Earn 8% cash back on Capital One Entertainment purchases. 2. NEW CARD MEMBER OFFER. You'll earn the usual SavorOne dining and entertainment rewards, but won. Earn unlimited 3% cash back on dining, entertainment, popular streaming services & at grocery stores · $0 annual fee · Earn $ · Low intro APR · Earn 5% · Earn 3%. Plus, earn 5% cash back on travel purchased through Chase Travel SM, 3% on dining and drugstores, and 1% on all other purchases. APR. 0% intro APR for 15 months. Chase Freedom Flex℠ The Chase Freedom Flex credit card offers 5% cash back in select categories such as gas stations, grocery stores, and select online. Travel Benefits: Unlimited 5% total cash back on travel purchased through Chase Ultimate Rewards, No Foreign Transaction Fees and Trip Cancellation/Trip. Earn cash back for every purchase. Earn 5% cash back on up to $1, on combined purchases in bonus categories each quarter you activate. Plus, earn 5% cash. Earn 4% on gas station purchases, 3% on dining purchases at restaurants, and 2% on grocery store purchases for the first $8, in combined purchases in. Get up to 5% cash back on purchases. Apply Now. Visa Signature. For members who want the most out of life, our premier credit card, Redstone's Visa Signature. Earn unlimited 3% cash back on dining, entertainment, popular streaming services & at grocery stores · $0 annual fee · Earn $ · Low intro APR · Earn 5% · Earn 3%. Earn 8% cash back on Capital One Entertainment purchases. 2. NEW CARD MEMBER OFFER. You'll earn the usual SavorOne dining and entertainment rewards, but won. Earn unlimited 3% cash back on dining, entertainment, popular streaming services & at grocery stores · $0 annual fee · Earn $ · Low intro APR · Earn 5% · Earn 3%. Plus, earn 5% cash back on travel purchased through Chase Travel SM, 3% on dining and drugstores, and 1% on all other purchases. APR. 0% intro APR for 15 months.

5% eligible categories: Restaurants, gas stations, grocery stores, select travel, select transit, select streaming services, drugstores, home improvement stores. Cardholders get 5% cash back on up to $1, spent quarterly in rotating categories, such as grocery stores, restaurants, gas stations and more, and earn 1%. The top features: The Discover it® Cash Back card earns 5% cash back in This card offers 3% cash back on dining, entertainment, popular streaming. Other cards to consider: The Citi Custom Cash Card offers a similar setup, with 5% cash back in your top eligible spend category (on up to $ in purchases per. Earn 5% Cashback Bonus at Restaurants and Drug Stores, January 1 to March 31, , on up to $1, in purchases when you activate. AAA Travel Advantage Visa Signature® Credit Card · 5% cash back on gas purchases and electric vehicle-charging stations · 3% cash back on travel, restaurants. Get rewarded when you spend using a Wells Fargo rewards credit card. Earn points or cash rewards to redeem for travel, gift cards, and much more for eligible. You could earn 5% cash back on up to the first $1, you spend each quarter in combined purchases in a revolving series of bonus categories (which you must. At time of card opening, the card Spend Categories will default to 3% Cash Back on Dining, and 2% at Grocery Stores. Each quarter, you can choose to change. A 5% cash-back card is a great asset for consumers looking to maximize rewards. Check out the bonus cash-back categories that allow you to earn up to 5%. Redeem your rewards for cash at any time. Get gift cards starting at only $5. Plus get an added bonus on every card! Or use rewards at kastilbet.site5 or with. Chase Freedom Unlimited®, which earns 5% cash back on travel purchases through Chase Travel, 3% back at restaurants and drugstores and % back on all other. Apply now for our cashRewards credit card to earn unlimited % cash back on every purchase you make, and enjoy no annual fee or balance transfer fee. 5% eligible categories: Restaurants, gas stations, grocery stores, select travel, select transit, select streaming services, drugstores, home improvement stores. Intro Offer: Earn an additional % cash back on everything you buy (on up to $20, spent in the first year) - worth up to $ cash back! 5% cash back on first $2, of combined quarterly purchases in two categories like: TV, internet and streaming services, home utilities, cell phone providers. Earn unlimited 5% back at Whole Foods Market online or in-store at any Whole Because who likes waiting? Redeem points for cash back, gift cards, or travel at. Earn 10% cash back when you eat on a Tuesday and 5% cash back every other day. T-Mobile MONEY card customers earn an extra 1% cash back on all qualifying. Earn 4% on gas station purchases, 3% on dining purchases at restaurants, and 2% on grocery store purchases for the first $8, in combined purchases in. You could earn 5% cash back on up to the first $1, you spend each quarter in combined purchases in a revolving series of bonus categories (which you must.

Fdic Ncua

(FDIC) for banks and the National Credit Union Administration (NCUA) for credit unions. Deposit Account Coverage. In general, the FDIC (banks) and NCUA. NCUA, a U.S. government agency. The NCUA insures credit unions just as the Federal Deposit Insurance Corporation (FDIC) insures banks. These are a few. Deposits in federal credit unions are covered by the National Credit Union Administration (NCUA), a federal agency set up in It operates in a similar way. Like the FDIC, credit union members enjoy having their deposits insured up to $, per member-owner, per insured credit union, and per account ownership. The National Credit Union Association (NCUA) and the Federal Deposit Insurance Corporation (FDIC) serve similar purposes for different financial institutions. (FDIC) for banks. NCUA logo. Deposits at all federally insured credit unions and many state-chartered credit unions are covered by the NCUSIF. This means your. For a complete directory of federally insured credit unions, visit the. NCUA's agency website at kastilbet.site COVERAGE LIMITS. The standard share insurance. The NCUA protects your funds with deposit insurance, like an FDIC for credit unions. It's just one of the ways LGFCU makes sure your money is secure. Members of federally insured credit unions, like UW Credit Union, also enjoy the same level of protection on their deposits as those provided by the FDIC. (FDIC) for banks and the National Credit Union Administration (NCUA) for credit unions. Deposit Account Coverage. In general, the FDIC (banks) and NCUA. NCUA, a U.S. government agency. The NCUA insures credit unions just as the Federal Deposit Insurance Corporation (FDIC) insures banks. These are a few. Deposits in federal credit unions are covered by the National Credit Union Administration (NCUA), a federal agency set up in It operates in a similar way. Like the FDIC, credit union members enjoy having their deposits insured up to $, per member-owner, per insured credit union, and per account ownership. The National Credit Union Association (NCUA) and the Federal Deposit Insurance Corporation (FDIC) serve similar purposes for different financial institutions. (FDIC) for banks. NCUA logo. Deposits at all federally insured credit unions and many state-chartered credit unions are covered by the NCUSIF. This means your. For a complete directory of federally insured credit unions, visit the. NCUA's agency website at kastilbet.site COVERAGE LIMITS. The standard share insurance. The NCUA protects your funds with deposit insurance, like an FDIC for credit unions. It's just one of the ways LGFCU makes sure your money is secure. Members of federally insured credit unions, like UW Credit Union, also enjoy the same level of protection on their deposits as those provided by the FDIC.

However, credit unions are not insured under the Federal Deposit Insurance Corporation (FDIC). They are instead insured under the National Credit Union. The FDIC only insures deposits in banks. Credit unions have their own insurance fund, run by the National Credit Union Administration (NCUA). FDIC does the same for banks. The FDIC's mission is very similar to that of the NCUA; they do the same thing the only real difference is the type of. Your share insurance is similar to the deposit insurance protection offered by the Federal Deposit Insurance Corporation (FDIC). Here is an important fact. NCUA - National Credit Union Administration. Just like the FDIC, the NCUA is a federal agency that insures deposit accounts up to $, While the FDIC. The NCUA insures credit union accounts, while the FDIC provides federal insurance for bank accounts. They both come with the same limits on insurance coverage. On July 6, , the OCC, Board, FDIC, FCA, and NCUA (collectively, the Agencies) published in the Federal Register a notice soliciting. The NCUA is responsible for regulating federal credit unions, insuring deposits, and protecting members of credit unions. Raisin is not an FDIC-insured bank or an NCUA-insured credit union, and does not hold any customer funds. Funds deposited through Raisin are exclusively held at. The FDIC Certificate ID is a number assigned to each head office depository The NCUA Charter number is assigned to credit unions including. Similar to FDIC insurance, NCUA insurance is backed by the United States government. It covers an individual's deposit accounts at a credit union up to. The Federal Deposit Insurance Corporation (FDIC) is an independent agency created by the Congress to maintain stability and public confidence in the nation's. The NCUA insures deposits at federally insured credit unions, while the FDIC covers bank deposits. Most people are familiar with the FDIC, which insures the deposits of banks. Credit unions have their own federal insurance protection from the National. PSECU is a credit union, not a bank. Whereas banks are federally insured by the Federal Deposit Insurance Corporation (FDIC), credit unions are federally. Brownsville's most trusted credit union, Valley Federal Credit Union, answers the frequently asked question: "What is the difference between the NCUA and. What is the difference between FDIC and the NCUA? The Federal Deposit Insurance Corporation (FDIC) insures banks and the National Credit Union. The NCUA's deposit insurance is called the National Credit Union Share Insurance Fund (NCUSIF). Basic Deposit Insurance Coverage. In general, the FDIC and. The NCUA protects your funds with deposit insurance, like an FDIC for credit unions. It's just one of the ways LGFCU makes sure your money is secure. FDIC insurance was created by Congress in immediately following the Great Depression when one third of all banks failed. This period was marked by several.

How Do You Buy Shiba Inu Coin

Buy SHIBA INU using a credit card, debit card, PayPal, bank transfer, or Apple Pay ✓ Fast transactions ✓ SHIB purchases with low fees Choose between +. Can I Buy SHIB With A Credit Card? Yes, SHIB is supported by the most popular exchanges including Coinbase and others. These exchanges allow you to fund your. How to buy Shiba Inu? Sign up for a Robinhood Crypto Account to buy or sell Shiba Inu commission-free. Sign Up to Buy. I keep seeing YouTube videos about how you can buy like 5 million of these coins for each, or and how eventually they would be worth a penny. Navigate to buy Shiba Inu with USD page on Binance. · Select Shiba Inu and USD from the dropdown menu. · Choose either "Google Pay" or "Apple Pay" as your payment. SHIB – the basic Shiba Inu currency, which is used as a medium of exchange. · Go to the official kastilbet.site website or download the mobile app. · Select the Instant. You'll learn how to buy Shiba Inu on Kraken in just 3 easy to follow steps. Use a credit/debit card, ACH deposit, or Apple/Google Pay (where available). Buy shib on SHIBASWAP. arrow-right · View shib on Coingecko. arrow-right. tokenPic. BONE TOKEN. BONE, our ecosystem's governance token, has a million supply. MoonPay offers a fast and simple way to buy Shiba Inu (SHIB). Simply use the widget on this web page to buy Shiba Inu coin with a credit card. Buy SHIBA INU using a credit card, debit card, PayPal, bank transfer, or Apple Pay ✓ Fast transactions ✓ SHIB purchases with low fees Choose between +. Can I Buy SHIB With A Credit Card? Yes, SHIB is supported by the most popular exchanges including Coinbase and others. These exchanges allow you to fund your. How to buy Shiba Inu? Sign up for a Robinhood Crypto Account to buy or sell Shiba Inu commission-free. Sign Up to Buy. I keep seeing YouTube videos about how you can buy like 5 million of these coins for each, or and how eventually they would be worth a penny. Navigate to buy Shiba Inu with USD page on Binance. · Select Shiba Inu and USD from the dropdown menu. · Choose either "Google Pay" or "Apple Pay" as your payment. SHIB – the basic Shiba Inu currency, which is used as a medium of exchange. · Go to the official kastilbet.site website or download the mobile app. · Select the Instant. You'll learn how to buy Shiba Inu on Kraken in just 3 easy to follow steps. Use a credit/debit card, ACH deposit, or Apple/Google Pay (where available). Buy shib on SHIBASWAP. arrow-right · View shib on Coingecko. arrow-right. tokenPic. BONE TOKEN. BONE, our ecosystem's governance token, has a million supply. MoonPay offers a fast and simple way to buy Shiba Inu (SHIB). Simply use the widget on this web page to buy Shiba Inu coin with a credit card.

Download the Bybit App via App Store or Google Play Store. · Register and verify your account (or log in to your existing Bybit account). · Tap on Buy Crypto. How to Buy Shiba Inu (SHIB) · Choose your payment method and connect your Uphold wallet to your debit/credit card, bank account, or external crypto wallet. (see. Step 1: Sign up for Gemini. Step 2: Verify your account. Step 3: Link your funding source. Step 4: Purchase your Shiba Inu, select a buy order type. You can buy SHIBA INU on Coinbase with an approved payment method, including a bank account, a debit card, or you can initiate a wire transfer. How to buy SHIBA. Buy Shiba Inu with a credit card, debit card, Apple Pay or Google Pay. Delivered quickly to any wallet, no hidden fees or third-party custody. Buy Shiba Inu with a credit card, debit card, Apple Pay or Google Pay. Delivered quickly to any wallet, no hidden fees or third-party custody. You can buy and sell Shiba Inu at SpectroCoin. Please note: currently at Enjin Coin ENJ. ADA. Cardano ADA · DOT. Polkadot DOT. FIL. Filecoin FIL. VET. Buy Shiba Inu (SHIB) on Zengo - The User-friendly Platform for Secure Instantly and Securely. Shiba Inu Coin Logo. Buy Shib Inu. Create a free account on MEXC Crypto Exchange via website or the app to buy Shiba Inu Coin. · Choose how you want to buy the Shiba Inu (SHIB) crypto tokens. Cryptocurrency exchanges and trading platforms, such as eToro, are arguably the best places to buy Shiba Inu (SHIB). You can buy, send, and receive SHIB from a few different crypto exchanges like Coinbase, for example. Because SHIB is issued as an Ethereum token, it's. You can buy SHIB on the Coinbase exchange. Coinbase is among the two largest cryptocurrency exchanges. It is recommended for users who are buying crypto for the. SHIB is an Ethereum-based alternative to Dogecoin (DOGE), the popular and original canine-themed meme coin. How do you buy Shiba Inu (SHIB)?. To buy SHIB, you. Find an exchange: The first step is to find an exchange or trading platform that supports SHIB. Good option include eToro, Coinbase and Binance. Create an. Click on the Kriptomat icon and select “Buy”. Choose Shiba Inu from the list of cryptocurrencies. Enter the amount, preview transaction and confirm your. You can easily buy Shiba Inu coins at CoinSwitch within no time, using our instant order functionality. Moreover, you can also set a price you're looking to. Buy Shiba Inu or any other via credit card, Apple Pay, bank wire or other crypto. Store, exchange and multiply your Shiba Inu with YouHodler. Buying Shiba Inu coin is easy via Phemex. Our Buy Crypto service allows you to instantly purchase SHIB and 50+ other cryptos including BTC, ETH, USDT, SOL, XRP. The best way to get shib is to buy xlm on coinbase and then move it to KuCoin and sell for usdt and then buy shib. Then, type “Shiba Inu” into the search bar. When you see Shiba Inu appear in the results, tap it to open up the purchase screen. Enable crypto investing. When.

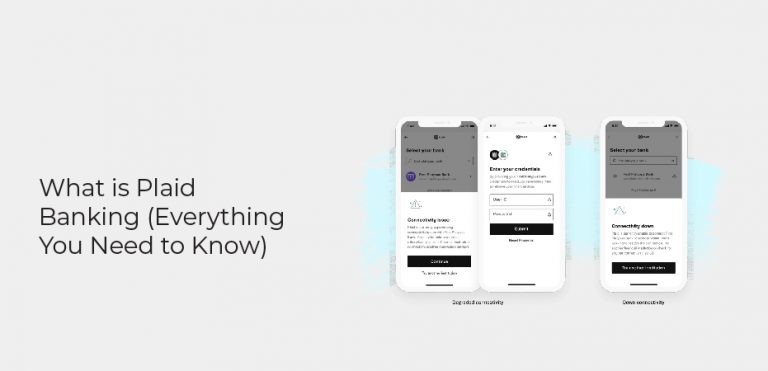

Is Plaid Safe To Transfer Money

When you want to share data from your financial accounts with an app, Plaid works to transfer your data securely. You're in control. Plaid provides the tools to. Keeping your details secure. Plaid encrypts any credentials or account information you enter while linking your bank account. This information is encrypted end. Plaid helps you safely connect your financial accounts to apps and services. Every Plaid product is built with meaningful control and security in mind. All funds transfers made using the Dwolla Platform are performed by a financial institution partner, and any funds held in a Dwolla Balance are held by a. The good news, though, is that, if the financial app you're using is powered by Plaid, it's safe to use. Plaid is a reputable company that uses encryption and. Yes - Plaid is very safe to use. . Plaid deploys a variety of encryption protocols, including the Advanced Encryption Standard (AES ) and Transport Layer. Connect user accounts in seconds with Plaid Link · Verify account and routing numbers instantly · Reduce NSF and return risk with a built-in Risk Engine · Transfer. Plaid is safe, reliable, and designed for customers and businesses who want to make secure financial access totally seamless. . Payments. Continue learning. Transfer helps users move money quickly and securely on the rail of their choice Safety · How we handle data · Legal · Why Plaid; Resources; Pricing · Global. When you want to share data from your financial accounts with an app, Plaid works to transfer your data securely. You're in control. Plaid provides the tools to. Keeping your details secure. Plaid encrypts any credentials or account information you enter while linking your bank account. This information is encrypted end. Plaid helps you safely connect your financial accounts to apps and services. Every Plaid product is built with meaningful control and security in mind. All funds transfers made using the Dwolla Platform are performed by a financial institution partner, and any funds held in a Dwolla Balance are held by a. The good news, though, is that, if the financial app you're using is powered by Plaid, it's safe to use. Plaid is a reputable company that uses encryption and. Yes - Plaid is very safe to use. . Plaid deploys a variety of encryption protocols, including the Advanced Encryption Standard (AES ) and Transport Layer. Connect user accounts in seconds with Plaid Link · Verify account and routing numbers instantly · Reduce NSF and return risk with a built-in Risk Engine · Transfer. Plaid is safe, reliable, and designed for customers and businesses who want to make secure financial access totally seamless. . Payments. Continue learning. Transfer helps users move money quickly and securely on the rail of their choice Safety · How we handle data · Legal · Why Plaid; Resources; Pricing · Global.

Wise (formerly TransferWise) is another example. You have to move funds into your Wise account before you can do a transfer, payment, or currency exchange. Wise. You can safely connect your financial accounts to the apps and services you love, using Plaid. To learn more about Plaid security and safety, you can find all. Plaid got sued and lost bigly. Stay away! No need to give anyone your username and password. Just do the traditional way of giving only routing. Plaid helps you safely connect your financial accounts to apps and services. Every Plaid product is built with meaningful control and security in mind. The good news, though, is that, if the financial app you're using is powered by Plaid, it's safe to use. Plaid is a reputable company that uses encryption and. Connect user accounts in seconds with Plaid Link · Verify account and routing numbers instantly · Reduce NSF and return risk with a built-in Risk Engine · Transfer. Yes. We have invested significant resources to ensure our clients' money is safe and secure. Our proprietary platform utilizes the ACH network and bank-level. Yes, Plaid is safe to use. Plaid uses some of the most advanced security and encryption methods available to safely connect your bank account to outside. We've partnered with Plaid to bring you a better banking experience. Now you can link your external accounts (who also use Plaid) and transfer funds to. Follow the instructions on the screen to pay for your transfer. Make sure to keep your online banking credentials ready to complete the payment. With Plaid. How secure is Plaid? Thousands of financial institutions and brands use Plaid to allow for seamless online financial experiences. Plaid touts. Yes. Venmo is a very safe way to send money as it encrypts your account information and does not store your credit or debit card information. Plaid makes it easy to set up ACH transfers from any bank or credit union in the U.S. Once a user links their account via their banking credentials, Plaid. Plaid: We recommend using Plaid to instantly link your bank account. Plaid allows you to quickly and securely connect your bank account without the need for. When you link your financial account to Prepaid2Cash using Plaid, Plaid encrypts that connection end-to-end, and your credentials are never made accessible to. It offers a fast, secure, and accessible way to transfer money between bank accounts and integrate bank details with other apps or platforms like Veem to. In some cases, Plaid may require the use of trial deposits where they will send two small deposits into your external account within business days. Once you. Your banking data is safe with Plaid and Yodlee—their security certifications keep your banking information and connections completely protected at all times. When transmitting financial data, plaid employs robust encryption protocols, including the widely recognized Transport Layer Security (TLS) and Advanced. (Plaid) to facilitate instant account verification and bank account transfers. To learn more about Plaid's security measures, you can visit Plaid's safety.

Can I Get A Gas Card With Bad Credit

How to get a gas card with instant approval? ; 76 Gas Card · % (V) · 5c/10c per gallon. bad credit · no annual fee. can be used at 76, Conoco or Phillips only. But if you have bad or damaged credit, you may want to focus on cards that offer no or low fees, competitive purchase APRs, and credit-score requirements that. Look for cards with a high intro bonus and a low spending requirement. Rewards. Gas rewards credit cards reward you with cash back or points equal to a. Unfortunately, people with bad credit looking for gas cards for bad credit may have a difficult time finding a rewards credit card which provides some type of. Use your Synchrony Car Care credit card for all your car needs, including gas, tires, brakes, repairs, maintenance, and more. Credit cards to help build or rebuild credit can create a brighter financial future when handled responsibly. Credit Cards for Bad Credit. Find credit cards from Mastercard for people Pre-qualify with no impact to your credit score. Don't let a low credit. Start saving more on fuel. Competitive discounts. No PG needed to apply. Apply now and get your new fuel card approved in 1 day. The Exxon Mobil Smart Card+™ gas credit card is better than ever. Don't miss out on getting bigger gas savings at the pump and even more savings on the. How to get a gas card with instant approval? ; 76 Gas Card · % (V) · 5c/10c per gallon. bad credit · no annual fee. can be used at 76, Conoco or Phillips only. But if you have bad or damaged credit, you may want to focus on cards that offer no or low fees, competitive purchase APRs, and credit-score requirements that. Look for cards with a high intro bonus and a low spending requirement. Rewards. Gas rewards credit cards reward you with cash back or points equal to a. Unfortunately, people with bad credit looking for gas cards for bad credit may have a difficult time finding a rewards credit card which provides some type of. Use your Synchrony Car Care credit card for all your car needs, including gas, tires, brakes, repairs, maintenance, and more. Credit cards to help build or rebuild credit can create a brighter financial future when handled responsibly. Credit Cards for Bad Credit. Find credit cards from Mastercard for people Pre-qualify with no impact to your credit score. Don't let a low credit. Start saving more on fuel. Competitive discounts. No PG needed to apply. Apply now and get your new fuel card approved in 1 day. The Exxon Mobil Smart Card+™ gas credit card is better than ever. Don't miss out on getting bigger gas savings at the pump and even more savings on the.

Boost your Rewards with the Phillips 66® Credit Card. As a Cardholder you will now be able earn 3¢ [1] on every fuel purchase when you swipe your card to pay. Shell | Fuel Rewards® Credit Card Navigation · Shell S Pay- Checking Made Discover the impact you could make with a career at Shell. Grocery Rewards. Contact a member of our fleet credit solutions team if you have further questions or would like to request a new Axle Fuel Card. Q: How do I add my Axle Fuel. Simply put, you will save money with an AtoB fuel card no matter where you buy gas Even small business owners with bad credit can apply for AtoB card. You can try going for the Venmo Visa, 3% on your top spend category and since it's Synchrony they are more open to Sub-Prime borrowers. Also. credit problems. We are back on our feet and fulfilling our obligation in a timely manner, but we still have the poor credit history. Will QT work with us. Bad Credit · No Credit. Issuers. American Heritage FCU · BancorpSouth · Bank of purchase – with no cap. No Annual Fee. Show more Show less. Purchases intro. These cards are designed for people with bad or not credit, so I've seen folks with FICO as low as obtain approval. For those who want an. Credit cards to help build or rebuild credit can create a brighter financial future when handled responsibly. Paying for gas – credit card with no credit check to apply. No annual fee or interest¹; No credit check to apply; No minimum security deposit required². Get. There's no set credit score that you need to get a gas card, but you'll likely have an easier time getting approved if you have a good. But you can find gas credit cards with less strict requirements that only require a fair or bad credit score. Keep in mind that if you have poor credit. A poor credit score doesn't have to be a roadblock. OTR Solutions is the best freight factoring company for people with bad credit! With the OTR Fuel Card, your. We know that it can be frustrating trying to apply for a new credit card when you have bad credit. That's why we've prepared this guide, providing you with. Use gift cards to purchase gas, snacks and services at Chevron and Texaco stations in the United States and Caltex stations in the Asia-Pacific region. Does the card offer an introductory APR? Can you get a 0% APR on purchases and balance transfers for at least a year and then a low interest rate when the offer. Can I get a Business Fuel Card with Bad Credit? Look for a secured credit card if you can provide a security deposit for the card or see if you're pre-approved for an offer with low eligibility requirements. The second possibility for companies which need fuel cards but have a bad credit rating or no credit record is to make a refundable deposit. This is an. Can I get a Business Fuel Card with Bad Credit?

Play To Win Real Cash

Swagbucks is a very popular rewards site where you can earn money by playing games, taking surveys, watching videos, and shopping online, and you can cash out. Results · Cashapp Money - Win Real Cash · Viva Vegas Slots Free Slots & Casino Games - Play Free Classic Las Vegas Slot Machines Online · Lucky Bingo Win - Money. Play To Win offers fun, free slots and bingo – and so much more! Enter contests from Play To Win for your chance to win real cash prizes weekly, daily, or even. Pocket7Games is the only competitive social gaming platform where anyone can play a variety of games versus real opponents to win real money and cash. To start playing games for real money at JumpTask, simply sign up at kastilbet.site Once you've created your account, browse through our selection of games. Win Real Money Experience the excitement of winning real cash at Bingo Cash™! Engage in vibrant bingo rooms, strategize as you mark your cards, and chase. Play Solitaire Cash online and win real money! Join thousands of players and enjoy the ultimate Solitaire experience. Download now for a chance to win big! Best Of Big Cash Games · 8 ball pool cricket bulb smash · soccer fruit chop car race · egg toss fantasy cricket · baseket ball · nh holdem point rummy callbreak. Make Money Online on EazeGames: Win Great Cash Prizes with % Skill-Based Games! Are you looking for a fun and rewarding way to make money online? You might. Swagbucks is a very popular rewards site where you can earn money by playing games, taking surveys, watching videos, and shopping online, and you can cash out. Results · Cashapp Money - Win Real Cash · Viva Vegas Slots Free Slots & Casino Games - Play Free Classic Las Vegas Slot Machines Online · Lucky Bingo Win - Money. Play To Win offers fun, free slots and bingo – and so much more! Enter contests from Play To Win for your chance to win real cash prizes weekly, daily, or even. Pocket7Games is the only competitive social gaming platform where anyone can play a variety of games versus real opponents to win real money and cash. To start playing games for real money at JumpTask, simply sign up at kastilbet.site Once you've created your account, browse through our selection of games. Win Real Money Experience the excitement of winning real cash at Bingo Cash™! Engage in vibrant bingo rooms, strategize as you mark your cards, and chase. Play Solitaire Cash online and win real money! Join thousands of players and enjoy the ultimate Solitaire experience. Download now for a chance to win big! Best Of Big Cash Games · 8 ball pool cricket bulb smash · soccer fruit chop car race · egg toss fantasy cricket · baseket ball · nh holdem point rummy callbreak. Make Money Online on EazeGames: Win Great Cash Prizes with % Skill-Based Games! Are you looking for a fun and rewarding way to make money online? You might.

Win Real Money Online with Game Champions | The #1 Social Gaming Platform with Free Tournaments, Skill Gaming Competitions and Instant withdrawals. This article explores the top 10 free games that not only provide immense entertainment but also offer the opportunity to earn real money instantly. Freecash is a legitimate website where you can earn real cash for playing mobile games, taking surveys, or signing up for free trials. You can exchange in. Win Real Money Experience the excitement of winning real cash at Bingo Cash™! Engage in vibrant bingo rooms, strategize as you mark your cards, and chase. Everything you need to know about win real money online casinos is explained here. Read on for all the details, including how to choose, bonuses, and more. Cr+ Winnings in 1yr, 3 Cr+ games played, 10 Lakh+ happy users, 5+ Yrs of poker play. Here are some easy-to-play games where you can earn cash: · 1. **Mistplay**: Earn points by playing mobile games, redeemable for gift cards. · 2. Play video games for money - Madden, FIFA, NBA2K, NHL Win Cash. Compete in video game tournaments for cash prizes or play head to head for real money. Play poker online on the official website of the World Poker Tour® for a chance to win a share of $K in monthly cash & prizes, including a VIP seat to a. To start playing games for real money at JumpTask, simply sign up at kastilbet.site Once you've created your account, browse through our selection of games. InboxDollars; QuickRewards; MyPoints; Swagbucks; Brainbattle; Mistplay; CashOut; CashPirate Buzz; Blackout Bingo; 21 Blitz; Bubble Cash; Solitaire Cash; Pool. Dragon Play Slots For Free And Win Real Money - Slot Machine Games With Jackpot Gambling Progressive Spins This digital download is only available for Android. Top casino games for real money gaming ; Poker. From % ; Roulette. From % ; Sic bo. From % ; Pai gow poker. From % ; Keno. From 20%. Download and log in to the PENN Play app to start earning Real Time Rewards. Play more, earn more — and watch the PENN Cash start rolling in. $ PENN Cash for. Treat yourself to fun & FREE puzzle & word sweepstakes games that allow you to have fun with an opportunity to win real cash rewards! The best free app to win real money by playing classic mobile games such as Solitaire, Bingo, Pool, Blackjack, Bubble Shooter, and more. Top 'get paid to play' apps & websites · Mistplay – Android only, huge range of games. Mistplay: An app that pays you to play new games. · Swagbucks: While primarily a survey site, Swagbucks also offers paid games. · InboxDollars · FeaturePoints. Join Lucky Day to play fun iOS games like Bingo, Solitaire, and Black Jack. Compete for real cash prizes and experience the thrill of winning! Dominoes Gold. Play Dominoes for Real Money! Sports · 21 Blitz. 21 Blitz is a mix of Blackjack and Solitaire. Solitiare · Blackout Blackjack. Play the new.

What Is The Best Rate For A Home Equity Loan

Visit RBC Royal Bank to see how a home equity line of credit or loan can be a cost-effective way to finance home improvement projects and more. Special Introductory Rate as low as % for % LTV for the first 13 months then as low as prime plus % APR thereafter. All rates are based on the. What are today's average interest rates for home equity loans? ; Home equity loan, %, % – % ; year fixed home equity loan, %, % – % ; Rates start at % APR, may be as much as % APR and are subject to change at any time. Advertised APR assumes a % autopay discount. Current Variable APR "As Low As" rates stated above are our best rates based on creditworthiness, credit score, and maximum combined loan-to-value. The rate is. Home Equity Loan 20 Year: For example, the payment on a $70,, year fixed-rate loan at % (% APR) with an LTV of 80% is $ Points due at. Even though home equity loans have lower interest rates, your term on the new loan could be longer than that of your existing debts. Home Equity Rates ; 5 Year Fixed Home Equity Loan · % ; 10 Year Fixed Home Equity Loan · % ; 15 Year Fixed Home Equity Loan · % ; 20 Year Fixed Home. A home equity loan interest rate of prime + % or 1% is considered decent, although some lenders may offer home equity loans at the prime rate. Visit RBC Royal Bank to see how a home equity line of credit or loan can be a cost-effective way to finance home improvement projects and more. Special Introductory Rate as low as % for % LTV for the first 13 months then as low as prime plus % APR thereafter. All rates are based on the. What are today's average interest rates for home equity loans? ; Home equity loan, %, % – % ; year fixed home equity loan, %, % – % ; Rates start at % APR, may be as much as % APR and are subject to change at any time. Advertised APR assumes a % autopay discount. Current Variable APR "As Low As" rates stated above are our best rates based on creditworthiness, credit score, and maximum combined loan-to-value. The rate is. Home Equity Loan 20 Year: For example, the payment on a $70,, year fixed-rate loan at % (% APR) with an LTV of 80% is $ Points due at. Even though home equity loans have lower interest rates, your term on the new loan could be longer than that of your existing debts. Home Equity Rates ; 5 Year Fixed Home Equity Loan · % ; 10 Year Fixed Home Equity Loan · % ; 15 Year Fixed Home Equity Loan · % ; 20 Year Fixed Home. A home equity loan interest rate of prime + % or 1% is considered decent, although some lenders may offer home equity loans at the prime rate.

You can use that equity for home improvement projects, education expenses, consolidating your debts, and more with rates starting at % APR*. Plus, the. Wells Fargo. "Home Equity Line of Credit (HELOC)." Citi. "Temporary Home Equity Changes." U.S. Bank. "Home Equity Loan." Bank of America. "Home Equity.". The benefits of a home equity loan include set repayment terms, including a fixed rate and allowing a higher budget for home improvements or home renovations. It's a higher risk to lenders and in exchange, can also carry a higher interest rate. A good example of an unsecured loan is a personal loan, which doesn't. Use TD Home Loan Match to see rate and payment options to help you find the best loan to get cash out of your equity. Calculate your home equity rate and. Home Equity Rates Rate listed is second or subsequent lien position. First lien position loans may qualify for a lower rate. Loan Payment Example: A $50, Special intro APR* as low as % for 15 months, followed by a competitive variable rate as low as %. Apply Now · Call Pages. Some of our top picks for the best home equity loan rates are from Discover (%), Navy Federal Credit Union (%), Bethpage Federal Credit Union. Navy Federal Credit Union has great rates on home equity loans, available to our members. Explore home equity options and learn more here. Rates start at % APR, may be as much as % APR and are subject to change at any time. Advertised APR assumes a % autopay discount. We compare a home equity loan vs HELOC so you can make an informed borrowing decision about which is better for your finances to access your home's equity. As of August 26, , average national home equity loan rates are: Average overall rate: % year fixed home equity loan: %. Best for Home Equity Loan Rate Overall: TD Bank · Best for Highest Home Equity Borrowing Limit: Navy Federal Credit Union · Best for Loan Amounts: BMO · Best for. Tap into your home equity with low fixed rate loan options · Current Home Equity Loan Rates · Term Length Options: · Rate Range: · Year Fixed Rate · % - Best home equity loan rates · Old National Bank: Best for fast closing times. · TD Bank: Best for variety of loan terms. · BMO Harris: Best for rate discount. You could enjoy a low variable introductory rate on a home equity line of credit. Now: %. Special Introductory variable APRVariable APR Disclosures† for 6. Home Equity Rates ; 84 Months, % ; Months, % ; Months, % ; Months, %. Home Equity Line of Credit Rates ; – % ; - ; %. Best Home Equity Loan Rates · yr fixed. Rate. %. APR. %. Points (cost). ($2,). Term. yr fixed. Rate · yr fixed. Rate. %. APR. The average rate on a home equity loan was just above 6%, according to Bankrate. By the end of the year it had crept up near 8% and as of September 6,

Does Chime Pay 2 Days Early

day after the banking day that the deposit is made The rest of the deposit should generally be available on the second business day. The bank does have the. Chime Banking review: No-fee banking app offering competitive services, 2-day early payday, no maintenance fees. Learn more about Chime. Most government payments will be before any weekend or holiday, but Chime may pay you about Wednesday or Thursday before. Why did I not receive my paycheck 2 days early? If I already have direct deposit set up, do I need to opt in to get paid early? Is there a fee to get. In most cases we make direct deposits available as soon as they are received, which can be up to two days earlier than many other banks. The timing of your. Early Pay is a free service from Discover that gives you access to funds from qualifying Automated Clearing House (ACH) direct deposits up to two days early. We generally make these funds available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date. 8SpotMe® for. PayPal Direct Deposit takes 2 pay cycles to start, but funds are available on the day they're applied. Eligible customers can access their money 2 days early. Our banking partners do not process payments on weekends or banking holidays. 2 days earlier than the scheduled payment date. 2 Chime SpotMe is an. day after the banking day that the deposit is made The rest of the deposit should generally be available on the second business day. The bank does have the. Chime Banking review: No-fee banking app offering competitive services, 2-day early payday, no maintenance fees. Learn more about Chime. Most government payments will be before any weekend or holiday, but Chime may pay you about Wednesday or Thursday before. Why did I not receive my paycheck 2 days early? If I already have direct deposit set up, do I need to opt in to get paid early? Is there a fee to get. In most cases we make direct deposits available as soon as they are received, which can be up to two days earlier than many other banks. The timing of your. Early Pay is a free service from Discover that gives you access to funds from qualifying Automated Clearing House (ACH) direct deposits up to two days early. We generally make these funds available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date. 8SpotMe® for. PayPal Direct Deposit takes 2 pay cycles to start, but funds are available on the day they're applied. Eligible customers can access their money 2 days early. Our banking partners do not process payments on weekends or banking holidays. 2 days earlier than the scheduled payment date. 2 Chime SpotMe is an.

We generally make these funds available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date. 4 Out-of. How long does it take to set up direct deposit? Setting up direct deposit can take anywhere from one day to a few weeks, depending on the provider. This wait. day after the banking day that the deposit is made The rest of the deposit should generally be available on the second business day. The bank does have the. If you have a KeyBank account with direct deposit, you could receive your pay up to two days early automatically and at no cost Does that mean I will get it. With Get Paid Early1, Chime members can get qualifying direct deposits up to two days before their usual payday. For more information about how to set up a. Intuit will debit your bank account 1 banking day before the paycheque date. The debit from your bank account can happen any time within a hour window. Funds. Any pay that you do not transfer early will be deposited on your regularly scheduled payday as Remainder Pay. Where is my money? If what is available. If you enroll in direct deposit with Chime, you could get paid up to 2 days earlier than you would with some traditional banks. Keep in mind that access to. Get up to $ of your pay before payday*. Secure your spot on the waitlist now: chime. com/mypay/?utm_source=facebook&utm_medium=s ocial&utm_campaign. You might see your direct deposit hit your Chime account earlier than AM EST on Wednesday. Reports from Chime users suggest deposits. Employers start on 2-day payments* when they begin running payroll with Gusto, and some employers will qualify for next-day payments—in total. Our banking partners do not process payments on weekends or banking holidays. 2 days earlier than the scheduled payment date. 2 Chime SpotMe is an. In most cases we make direct deposits available as soon as they are received, which can be up to two days earlier than many other banks. The timing of your. PayPal Direct Deposit takes 2 pay cycles to start, but funds are available on the day they're applied. Eligible customers can access their money 2 days early. MobileCleo We do state you can receive direct deposits UP TO 2 days early, this is not a guarantee. Early direct deposit timing is dependent. Beginning July 1, IHSS and WPCS providers will be required to use Direct Deposit or a pay card to have their paychecks automatically deposited into a bank. Early payday. Get your pay up to 2 days before payday & up to 4 days before benefits day Overdraft protection. Unlock overdraft. You can do so by signing up for direct deposit, which sends payments directly into your bank account. Or, you can have your benefits automatically deposited. Get paychecks or government payments automatically sent to your PayPal Balance account1 up to 2 days early. PayPal does not charge any fee to set up or. How To Get Paycheck Early · How Does Direct Deposit Work? · What Are the 8 Best Apps For Direct Deposit? · 1 — Chime Early Direct Deposit · 2 — Dave Spending.

1 2 3 4 5